Yesterday’s Advisor began the results of our 2014 Retirement Benefits Survey. Today, more survey results plus good news—we’re able to offer reader a free webinar on Affordable Care Act strategies.

|

Changes Contemplated

Our survey shows that 9.8% plan to add or make changes to their 2015 retirement benefits package, 64.9% of employers have no additions or changes planned, and 25.3% are not certain at this point in time.

For those who are planning to add or make changes to their retirement benefits, 27.4% are planning to add a defined contribution plan such as a 401(k), 403(b), or Roth 401(k) and 20.8% are planning to increase their employer match to their existing defined contribution plan, while 6.6% are planning to reduce the level of their employer match.

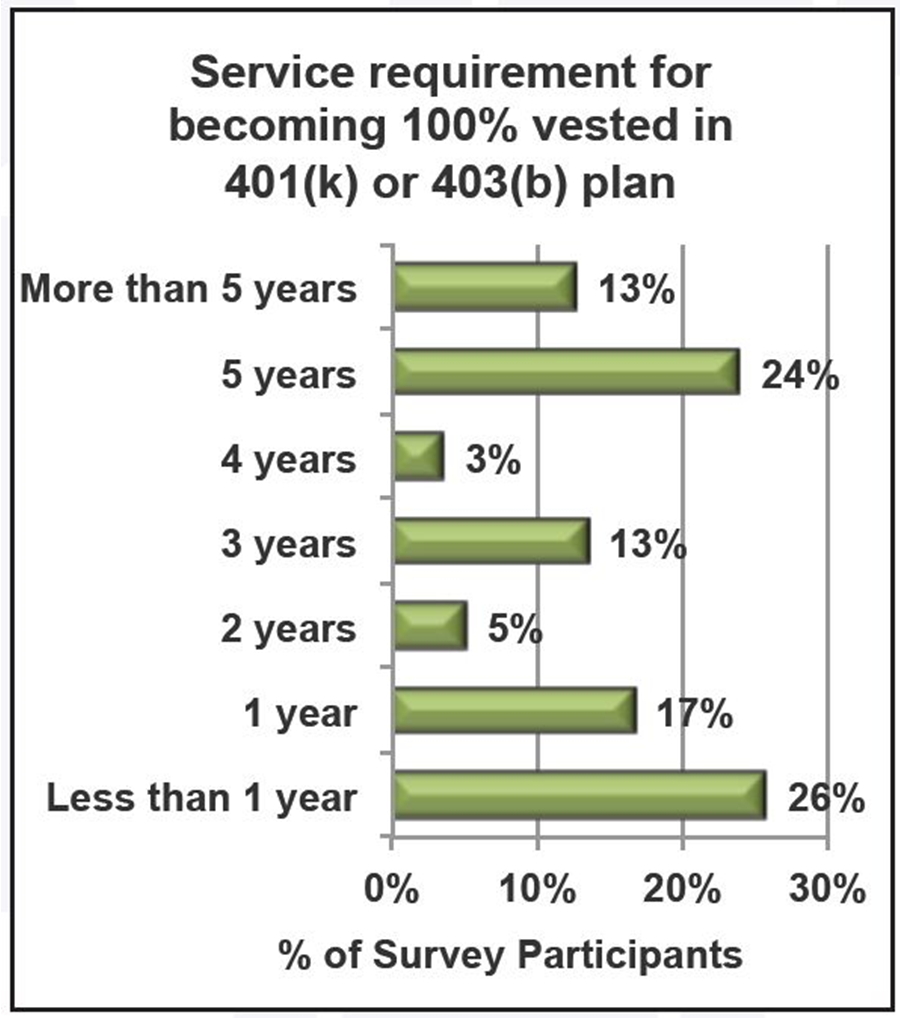

An increase in the length of service required for vesting of employer contributions is planned for 5.7%, and 8.5% plan to reduce their length of service requirement.

Cleaning up the language in their plan documents is a priority for 25.5%, and a change in how documents are distributed is planned for 12.3%. Current defined contribution plans will be eliminated for 8.5% (up from 3% last year) of participants who answered this question in our survey.

The addition of a defined benefit plan is planned for 7.5% (5% in 2013) and 14.2% (9% in 2013) expect to increase the employer contribution to their existing plan. For 11.3% (10% in 2013), however, a reduction in their employer contribution is planned.

It’s almost an even split when it comes to whether employers offer financial planning assistance to their employees, with 47.4% offering such assistance and 48.9% not providing this service to employees. The remaining 3.8% aren’t sure whether this benefit is offered.

ACA still slowing you down? Move into high gear on April 9 2014 with an free interactive webcast, The Affordable Care Act: Compliance is Just the Beginning. Learn More

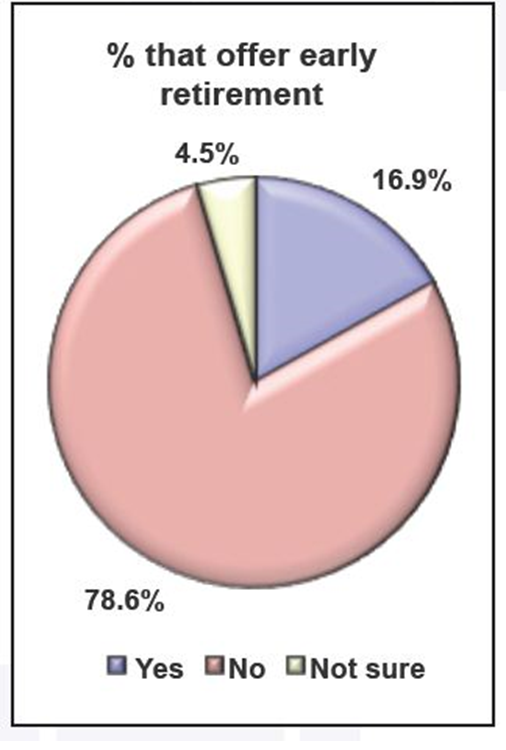

Early Retirement

Early retirement is an option for the employees of 16.9% of our survey participants. It is not offered by 78.6%, though, and 4.5% aren’t sure. Of the employers that do offer early retirement, 18.3% ask the retiring employees to sign a waiver/release of claims against the company. Surprisingly, 63.4% (55% in 2013) do not make signing a waiver/release a requirement, and 18.3% are not sure if it’s a requirement.

Who Participated in the Survey?

A total of 1,612 individuals participated in this survey, which was conducted in February 2014. Of those who identified themselves, 54% represent privately owned companies, 12% are with public entities, 8% work for government, and nonprofit organizations account for 22%.

HR/benefit managers and directors account for 55% of the survey participants who self-identified, other HR/benefit professionals make up 15%, 10% are VP level or higher, and 20% are in other areas with HR responsibilities.

The majority (58%) of our survey respondents provide HR services to a workforce of 1 to 250 employees. Another 13% provide guidance to 251 to 500 employees at their organizations and 10% have a workforce of 501 to 1,000 employees. Companies with more than 1,000 employees account for 18% of survey participants.

Over half (53%) of the participants are in service industries; 23% are in agriculture, forestry, construction, manufacturing, or mining; 7% are in wholesale, retail, transportation, or warehousing; and 4% are in real estate or utilities. The remaining 14% selected other.

A 50 to 100% unionized workforce applies to 7% of the employers surveyed. Also, 81% have a workforce with no union-represented employees. Exempt employees account for more than 50% of their workforce for 26% of survey participants.

Note: Not all participants answered all questions in the survey. Numbers have been rounded to the nearest percent.

When it comes to benefits, nothing causes hassles like the Affordable Care Act. Complying and implementing are fraught with twists and turns. But, it doesn’t have to be so hard. Having the right fundamentals—strategy, data and technology—can help your organization stay ahead no matter how the story evolves.

Fortunately there’s timely help in the form of BLR’s new free webcast—The Affordable Care Act: Compliance is Just the Beginning In just 60 minutes, you’ll learn what you need to know to continue implementing the ACA.

Join Scott Barker of Kronos and guest speaker Mollie Lombardi, VP and principal analyst of Aberdeen’s Human Capital Management practice on April 9 as they explore Aberdeen’s latest research looking at how organizations are gearing up to support the requirements of the Affordable Care Act.

Date or time doesn’t fit your schedule? Go ahead and register anyway. We will be sure you receive an email with a link to the recorded webcast following the event.

Register today for this free interactive webinar.

ACA compliance? Good news! Join us April 9 for a free interactive webcast: The Affordable Care Act: Compliance is Just the Beginning. Earn 1 hour in HRCI Recertification Credit. Register Now

By participating in this interactive webcast, you’ll learn how to:

- Align your ACA strategy with your overall talent strategy

- Cope with complex and changing laws

- Drive compliance throughout your organization

- Understand the role technology plays to properly manage compliance

April 9, 2014

2:00 p.m. (Eastern)

1:00 p.m. (Central)

12:00 p.m. (Mountain)

11:00 a.m. (Pacific)

Approved for Recertification Credit

This program has been approved for 1 recertification credit hours toward recertification through the Human Resource Certification Institute (HRCI).

Join us on April 9—you’ll get the free, in-depth The Affordable Care Act: Compliance is Just the Beginning webcast AND you’ll get all of your particular questions answered by the experts.

Train Your Entire Staff

As with all BLR/HRhero webcasts:

- Train all the staff you can fit around a conference phone.

- You can get your (and their) specific phoned-in or emailed questions answered in Q&A session that follows the presentation.