Highlights of our 2014 Perks Survey of over 2,000 employers:

- Paid holidays is the number one perk.

- Also in the top five: life insurance, LTD, STD, and paid vacation.

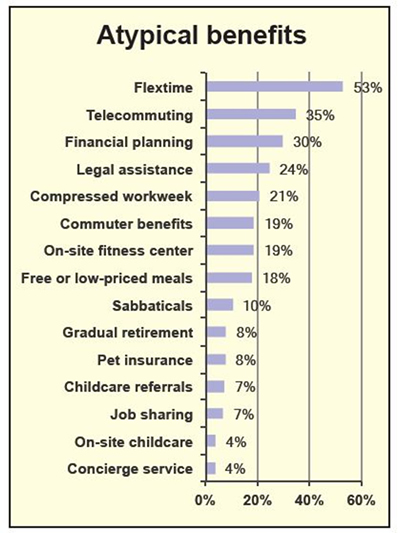

- For exempt employees, flextime is offered by 60.9%.

- Other benefits being offered include:

- Financial planning assistance (51.7%)

- Telecommuting (49.2%)

- Legal assistance programs (39.8%)

- On-site fitness centers (29.2%)

- Commuter benefits (24.7%).

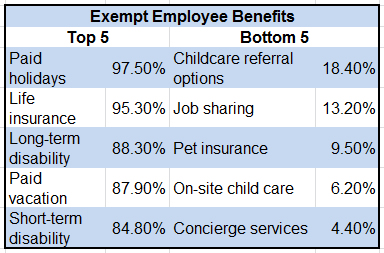

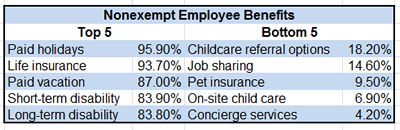

Paid holidays is the number one perk provided for both exempt and nonexempt employees, with 97.5% and 95.9%, respectively. Up from last year (85%), life insurance is provided by 95.3% for exempt employees and by 93.7% for nonexempt employees. Rounding out the top five benefits for exempt employees are long-term disability, paid vacation, and short-term disability. The top five for nonexempt employees includes paid vacation for 87%, short-term disability for 83.9%, and long-term disability for 83.8%.

At the other end of the spectrum, the least-offered benefit is concierge service at 4.4% for exempt and 4.2% for nonexempt. The bottom five benefits also include on-site child care, pet insurance, job sharing, and childcare referral options.

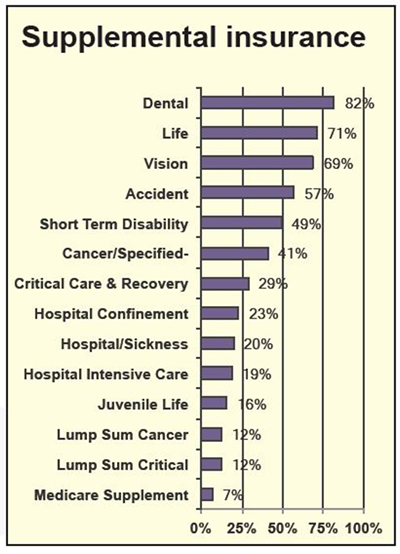

Supplemental Insurance

Voluntary supplemental insurance plans offered to exempt employees include dental insurance, topping the list at 95.3% of employers, and vision insurance, coming in second at 85.9%. Accident insurance is next at 83.2%, then life or juvenile life at 80.3%. Lump sum cancer and lump sum critical illness insurance are both offered by 52.6% (up from 12% in 2013), and the least-offered voluntary benefit is Medicare supplement, by 36.5% of the employers responding to our survey.

For nonexempt employees, the picture varies only slightly, with dental topping that list at 94%, followed by vision insurance at 85%. Accident insurance comes in third on this list as well, for 82.6%.

Incentive pay not accomplishing what you want it to? Figure it out on May 20 with an interactive webinar, Variable Pay: Using Incentive Compensation to Boost Performance Beyond the Merit Pay Process. Learn More

Atypical Benefits

For exempt employees, flextime is the most commonly offered (60.9%) atypical benefit offered by employers. Other atypical benefits being offered include: financial planning assistance (51.7%), telecommuting (49.2%), legal assistance programs (39.8%), on-site fitness centers (29.2%), and commuter benefits (24.7%). The least-offered atypical benefits are on-site child care (6.2%) and concierge services (4.4%).

For nonexempt employees, however, financial planning assistance tops the list at 50.9%, followed by flextime at 48.4%. Other atypical benefits being offered to nonexempt employees include legal assistance programs (39.2%), telecommuting (27.8%), commuter benefits (23.4%), and job sharing (14.6%). The least-offered atypical benefits are on-site child care (6.9%) and concierge services (4.2%).

When asked how their benefits compare with their competitor employers, 39% indicated they were about the same, 37.8% responded that their own benefits are more generous than their competitors’, and 8.5% indicated that their benefits are less generous.

Benefits Planning

Conducting employee surveys is the method used by 23.8% of employers to determine what nonwage benefits to offer employees and 38% use surveys to evaluate the benefits offered by other companies as well as their competitors. Hiring a consultant to develop a benefit plan, however, is the norm for 61.4%.

A little over half (52.5%) of survey participants conducted a comprehensive evaluation of their benefits packages in 2013 and 24.6% have done so in 2014. A review of benefits was conducted in 2012 for 8.6% and in 2011 for 2.6%. It was before 2011, though, for 11.8%.

No changes are planned in 2014 to 2015 for 13% of survey participants. Minor changes are in store for 49.3 and moderate changes are planned for 30.7%. Significant changes are on deck, however, for 7%.

Incentive pay—always hard to hit the mark. Join us for an interactive webinar, Variable Pay: Using Incentive Compensation to Boost Performance Beyond the Merit Pay Process. Earn 1.5 hours in HRCI Recertification Credit. Register Now or Find Out More

Tuition Reimbursement

Both exempt (71.2%) and nonexempt (69.6%) employees are eligible for tuition reimbursement and part-time employees are eligible for 17.8% (down from 21% in 2013). For those that offer this benefit, less than a year of employment is required for employees to be eligible at 42.1%, and at least 1 year is required for 49.1%.

The maximum annual amount of tuition reimbursement is less than $1,000 for 16.9% of survey participants. It is up to $2,000 for 27% and as much as $3,000 for 14.5% of employers. The reimbursement level is above $3,000 for 42.3%.

Repayment of tuition reimbursement is never required by 30.5% of employers, even if the employee leaves the company. Repayment is required on a case-by-case basis for 17.3%. It depends on the timing of the departure for 52.2%.

In tomorrow’s Advisor, the rest of the survey results, plus we announce a timely webinar on variable pay and incentives.