BLR’s 2014 Variable Pay Survey reveals that almost two-thirds of participants put some employee pay at risk. Some 1,452 employers participated in the recently completed survey. Here are some highlights:

|

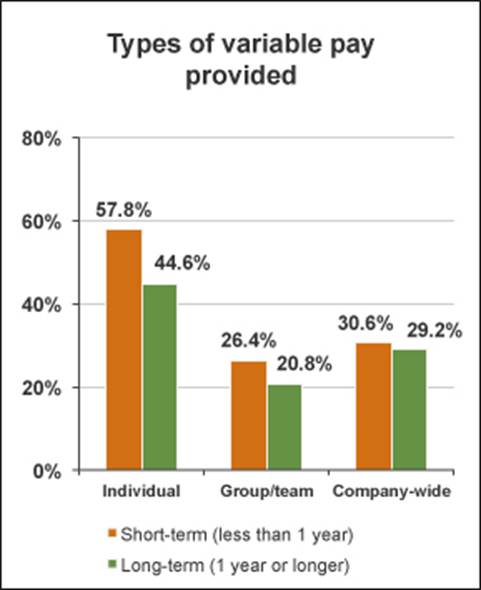

- Individual short-term incentives (less than 1 year) are offered by 57.8% of survey participants who responded to the question.

- The three most important reasons why employers provide variable pay are to:

- Improve individual performance/productivity, 61.5%;

- Recognize employee contribution to the organization, 59.3%; and

- Improve overall productivity, 44.2%.

- 53.8% indicated variable pay is very important for attracting senior management candidates, and it’s very important for attracting middle management to 43.8%.

Thanks to all 1,452 participants! Here are the detailed responses:

Types of Variable Pay

Individual short-term incentives (less than 1 year) are offered by 57.8% of survey participants who responded to the question, and 44.6% provide long-term incentives (1 year or longer) as well. Companywide short-term incentives are an option for 30.6% and long-term variable pay is offered by 29.2%. When it comes to group/team short- and long-term incentives, however, the numbers dip down to 26.4% and 20.8%, respectively.

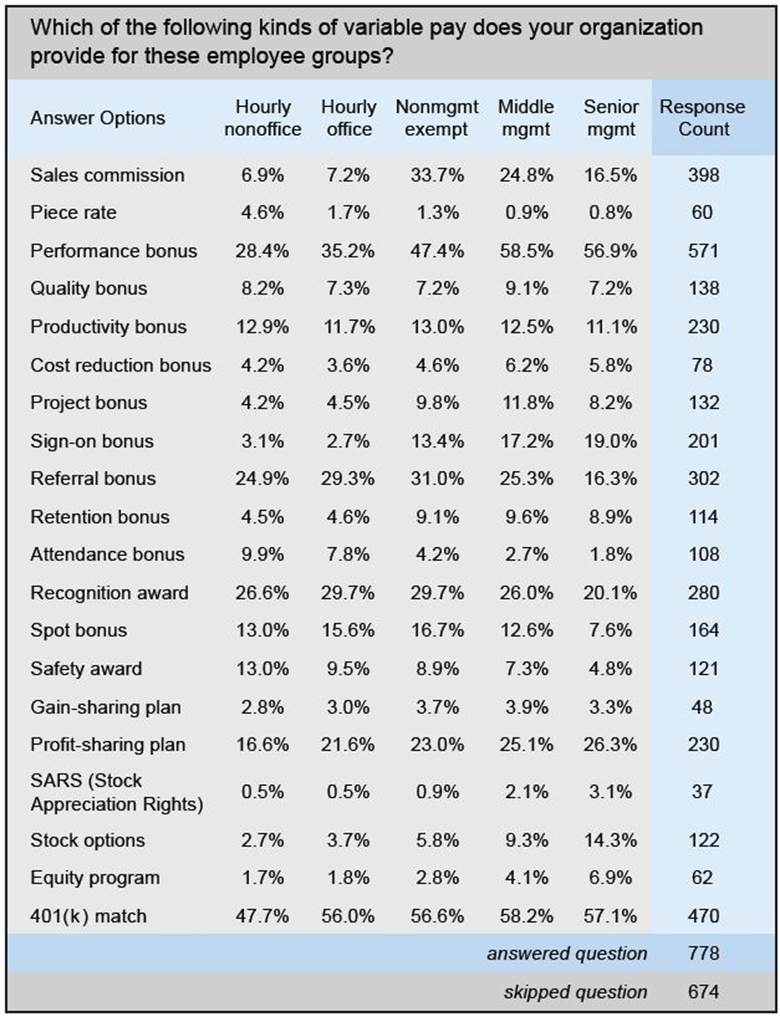

The most commonly offered variable pay is 401(k) match, with an average of 55.1% across all employee types. Digging into the details, though, reveals that performance bonuses top the list for middle management employees (58.5%). It’s offered second most, however, for hourly nonoffice (28.4%), hourly office (35.2%), non-management exempt (47.4%), and senior management (56.9%) employees.

Free Download—5 Easy Steps to a Smart Compensation Plan. The experts at PayScale have created a succinct, step-by-step guide to compensation planning and salary benchmarking. Free download. Check it out.

Objectives

The three most important reasons for why employers provide variable pay are to:

- Improve individual performance/productivity, 61.5%;

- Recognize employee contribution to the organization, 59.3%; and

- Improve overall productivity, 44.2%.

Offering variable pay as a means to better manage compensation costs is an objective for 11.3%, and to reduce employee turnover is a goal for 23.1% of survey participants who answered this question.

When asked how important variable pay is for attracting qualified talent, 53.8% indicated that it’s very important for attracting senior management candidates and it’s very important for attracting middle management to 43.8%. It’s important for attracting nonmanagement exempt employees to 34.6%. It is moderately important for attracting hourly office to 26.7% and for recruiting hourly nonoffice to 21.2%.

The actual numbers vary a bit but the above pattern, for the most part, holds true regarding the importance of variable pay for successfully retaining valued employees. It is very important for keeping senior management on board to 47.6% and for retaining middle management to 38.2%. It is important for keeping nonmanagement exempt employees on deck to 30.8%. It’s moderately important for keeping hourly office employees to 20.4% but not important for keeping hourly nonoffice to 21.4%.

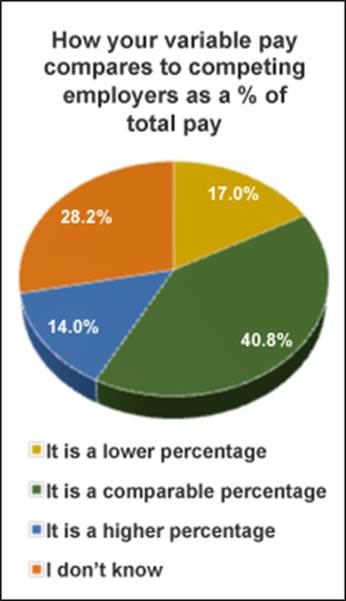

Compared to other employers in their labor market, 40.78% indicate their variable is a comparable percentage of total pay. It is a higher percentage, however, for 14% and a lower percentage of total pay for 17%.

Sales commission tops the list of variable pay types that are “very effective” at motivating employees to achieve higher levels of performance for 27% of survey participants, followed by performance bonuses (24.2%) and 401(k) match (19.4%). SARS, piece rates, and gain-sharing plans at 2%, 2.5%, and 2.8%, respectively, landed at the lowest end of the list of “very effective” motivators.

Topping the list of “not effective” motivators is 401(k) match for 8.6%, followed by referral bonuses for 8.3% and sign-on bonuses for 6.9% of survey participants.

Comp Plan Guide—Free Download—The experts at PayScale have created a succinct, step-by-step guide to compensation planning and salary benchmarking, 5 Easy Steps to a Smart Compensation Plan. Free download here.

Plan Payout

More than half (53.5%) of survey participants cap their 401(k) match and 48.5% cap performance bonuses. Referral bonuses are capped by 26.5%, recognition awards are capped by 24.4%, and sales commissions are capped by 16.3%.

The frequency with which variable pay plans pay out to employees varies with the plan. For example, 401(k) match is paid weekly for 19.7%, monthly for 18.1%, quarterly for 3%, semiannually for .5%, and annually for 13.4%. Sales commissions, however, are paid weekly for 3.6%, monthly for 25.6%, quarterly for 18.6%, semiannually for 3%, and annually for 6.1%. Performance bonuses are just the reverse with 49.7% paid out annually, 4.8% paid semiannually, 11.8% paid quarterly, 8.1% paid monthly, and 2% paid weekly.

Some level of goal achievement is required before payout is made for most variable pay plans. For performance bonuses, 100% of goal achievement is required by 19.2% of survey participants, 76–100% achievement is required by 24.5%, and a goal achievement of 76% or less is required before payout is made for 10%.

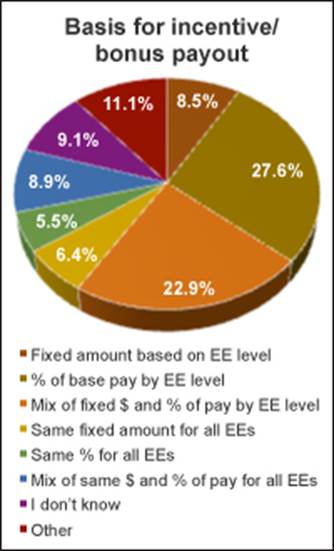

Incentive/bonus payout is based on a percent of base pay tied to employee level for 27.6% and to a mixture of fixed amount and percent of base pay, both tied to employee level, for 22.9%. Payout is a mixture of the same fixed amount and percent of base pay regardless of employee level for 8.9%.

In tomorrow’s Advisor,more survey results, including how respondents fund incentives, how they communicate their plans, how they evaluate, and how they would improve them, plus we introduce a free download compensation planner, 5 Easy Steps to a Smart Compensation Plan.