Yesterday’s Advisor began our coverage of the incentive Pay Survey; today, more survey results, including how respondents fund incentives, how they communicate their plans, how they evaluate, and how they would improve them.

Funding of Incentives

Our survey looked at four types of funding for variable pay plans, including discretionary funding, a percent of payroll, reduced costs, and/or increased revenue. Performance bonuses (24.3%), referral bonuses (22.7%), and 401(k) match (14.6%) are the top three plan types supported by discretionary funds. The top three funded by a percent of payroll are 401(k) match (33.4%), performance bonus (22.8%), and sales commission (9.6%).

Understandably, cost reduction bonus at 5.7% leads the list of variable pay plans funded by reduced costs, followed by performance bonus at 4.7%. Referral bonus and productivity bonus tie for third place at 3.5%. Sales commission (34.2%) tops the list of plans funded by increased revenue. Performance bonus (20.1%) comes in second with productivity bonus third in that list at 13.4%.

Updating

Updating their variable pay plans is as recent as within the last year for 42.9% of survey participants and within the last 2 years for 23.7%. Their plans were updated within the last 5 years for 16.7% and 11% are working with plans that have never been updated.

Free Download—5 Easy Steps to a Smart Compensation Plan. The experts at PayScale have created a succinct, step-by-step guide to compensation planning and salary benchmarking. Free download. Check it out.

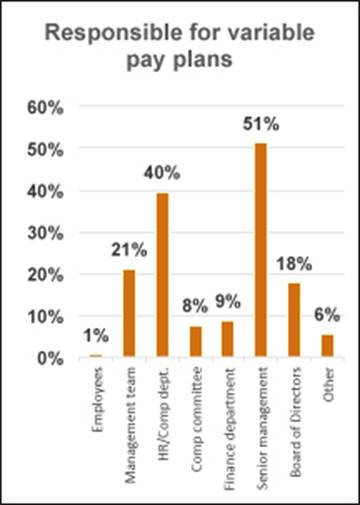

Responsibility

The HR/Compensation department has primary responsibility for designing and implementing plans for 39.6% of survey participants. Senior management, however, carries that responsibility for 51.3%.

Improvements Suggested

Ensuring that all employees have a clear “line of sight” regarding effort/performance to payout/reward is one way that 59.6% of survey participants believe their variable pay plan can be improved and 54.5% think that ensuring that performance goals align with corporate and department objectives will improve the program. Improving communication and increasing understanding of the plan and its objectives are tactics 51.6% could use to improve their plan. Other improvement methods include:

- Clarifying more precisely what specific performance will earn the incentive, 46.1%

- Ensuring performance goals are more attainable, 31.5%

- Eliminating performance goals that conflict with one another, 18.5%

- Streamlining implementation and administration of program(s), 26%

- Increasing the number or frequency of opportunities for employees to receive payout, 26.3%

- Increasing the number of employees eligible to receive payout, 20.6%

- Other, 4.2%

Communicating

More than one method of communication is used by survey participants to explain variable pay plans to employees, including:

- Bulletin boards or intranet, 19.8%

- Employee meetings, 39.8%

- Written materials, 49.8%

- One-on-one meetings with supervisors, 46.7%

- Other, 7%

Communicating variable pay plans can be a challenge. Many are often complicated plans with intricacies that may be difficult to explain to even the most business savvy of employees. For example, only 62.4% of survey participants believe that all of their senior management team understand their variable pay program. All of middle management team members understand their programs for 42.3% and all of non-management exempt employees understand it for 27.9%.

Comp Plan Guide—Free Download—The experts at PayScale have created a succinct, step-by-step guide to compensation planning and salary benchmarking, 5 Easy Steps to a Smart Compensation Plan. Free download here.

Evaluating Effectiveness

As a general rule, measuring the effectiveness of any program is important and variable pay plans are no exception. Profit/loss metrics are used by 33.2% of survey participants to ensure their plan achieves its goals and 30.1% use organizational operating metrics. Other measurements include:

- Employee productivity, 28%

- Informal employee opinion, 24.4%

- Formal employee satisfaction survey, 22.5%

- Employee turnover, 21.4%

- Other, 4.3%

Surprisingly, 29.9% do not measure the effectiveness of their variable pay plans.

Participants

A total of 1,452 organizations participated in this survey, which was conducted in July 2014, though not all participants answered all questions. Of those who identified themselves, 64.2% are private, for-profit organizations; 18.2% are private, not-for-profit; and 17.6% are public sector.

Less than 25% of the respondents have a workforce of more than 50% exempt employees. Less than 28% of the employers surveyed have a 50–100% unionized, nonexempt workforce. Also, 47.4% have a nonexempt workforce that is less than 25% union members.

Almost two-thirds (63.3%) of the participants are in service industries; 24.4% are in agriculture, forestry, construction, manufacturing, or mining; 9.3% are in wholesale, retail, transportation, or warehousing; and 3.1% are in real estate, utilities, or “other.”

Staff level employees account for 13.7% of the survey participants who self-identified, supervisors or managers make up 40.6%, director level account for 25.6%, and 20.1% are VP level or above.

Once again, thanks to all who participated in the survey. Upcoming surveys:

- Employee leave

- Holidays

Incentive pay, just part of a complete compensation plan. How’s yours? Not as complete or up-to-date as you wish it were? Here’s good news in the form of a free download from the experts at PayScale: 5 Easy Steps to a Smart Compensation Plan.

As the HR leader at your organization, it’s important that you can efficiently lead your company through either developing or updating its current compensation plan.

Whether you are creating a formal compensation plan for the first time or updating an old one, this free download will get you on the right track. Here’s a barebones outline of what you’ll find in 5 Easy Steps to a Smart Compensation Plan.

Step 1: Plan Ahead

1. Get buy-in from company leadership.

2. Complete your job descriptions.

3. Develop your compensation philosophy.

Step 2: Perform Salary Benchmarking

1. Select sources of salary market data.

2. Choose positions to benchmark.

3. Age your data.

4. Weigh your data.

Step 3: Establish Your Pay Grades and Salary Ranges

1. Create pay grades.

2. Calculate the midpoint of each salary range.

3. Determine salary range widths by position or grade.

4. Calculate the minimum and maximum of each salary range.

Step 4: Complete Compensation Analytics

1. Analyze employee pay.

2. Choose who to green or red circle.

Step 5: Be Consistent and Schedule Regular Updates