Back to Normal: Ending COVID-19 Tolling of COBRA Deadlines

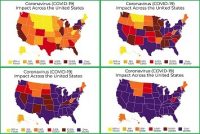

Getting “back to normal” as the COVID-19 pandemic has eased has not been simple for anyone. In terms of plan administration, the continued tolling of employee benefit plan deadlines, including those related to continuation coverage under the Consolidated Omnibus Budget Reconciliation Act (COBRA), has kept plan administrators firmly planted in a “COVID-19 world,” even as […]