Where are benefits heading? To Value-Based Benefits Design (VBBD), says consultant Carla McCormick. If you are not evaluating VBBD for your company, you are ignoring large potential savings, she adds.

|

What is VBBD? It’s about taking a comprehensive approach to helping employees be healthier—and helping the company save money. McCormick, a consultant with Fallon Benefits Group in Atlanta, made her remarks at BLR’s Advanced Employment Issues Symposium, held recently in Las Vegas.

What Are the Keys to VBBD?

McCormick offers the following necessary components for a successful VBBD:

- Accountable, engaged patient. Participants (employees and dependents) must be ready to take responsibility for their own health.

- Removal of barriers to appropriate care. Participants fail to seek care for many reasons and, if those reasons can be eliminated, more will seek care. This might, for example, mean eliminating copays or otherwise changing coverage.

- Alignment of incentives. To the extent possible, says, McCormick, align incentives between stakeholders:

- Patients

- Providers

- Payers

- Comprehensive communication strategy. Communication is much more important than most employers realize, says McCormick. Employees will make wrong assumptions if you are not very clear about what is happening. Keep preaching, “We don’t see the data.” Otherwise, you’ll hear employees saying:

- “I don’t like the employer pulling my strings.”

- “I don’t trust them to keep it confidential.”

- McCormick tip: Keep employer branding off the documents.

- Data availability. VBBD programs are designed based on data about demographics, biometric measures, and so on. The VBBD plan addresses the specific problems found in the particular group of employees and dependents.

VBBD programs may include:

Individual Health Competency

Individuals are motivated through cash equivalents or premium differentials with programs such as:

- Health-risk assessments

- Biometric testing

- Health fairs

- Wellness program participation

- Tobacco cessation

- Stress management

Condition Management

In addition, programs target particular conditions that are expensive. Participants are incented through copay/coinsurance differentials or cash equivalents. Programs stress:

- Adherence to chronic condition medications

- Adherence to evidence-based guidelines

- Participation in a disease management program

“I’m all set with the new health care rules.” NOT. Join us for an interactive webcast on January 21 2014 all about the Affordable Care Act and your 2014 obligations. Learn More

Provider Selection

Provider selection is also an important component, says McCormick. Participants are motivated through copayment or coinsurance differentials for:

- Utilization of a retail clinic versus an emergency room.

- Care through a “center of excellence.”

- Use of a Tier One high-quality physician.

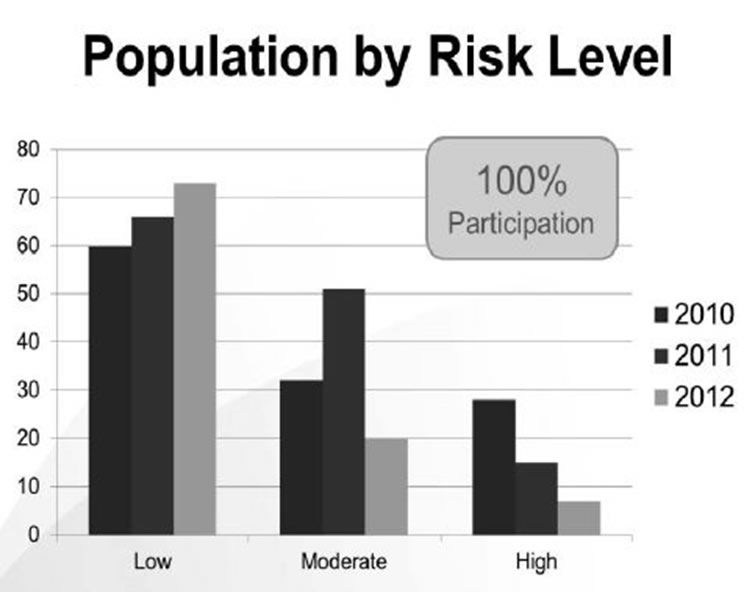

One way to look at VBBD is that you try to manage the most expensive conditions to bring them down out of the most expensive category, and keep the healthy people healthy so they don’t move into that expensive category. Here’s a chart that shows the results that one client had:

As the chart readily illustrates, this company significantly reduced the number of participants in the high-risk (and very high-expense) group.

What Activities Are Rewarded?

Here’s a chart that shows the percentages of companies in a recent survey that are rewarding the indicated activities.

What types of Incentives Are Offered?

McCormick offers the chart below to indicate which incentives are offered.

Other incentives McCormick has seen offered include time off, prime parking spaces, and free lunches.

Affordable Care Act 2014 obligations clarified and explained in plain English, plus1.5 hours in HRCI Recertification Credit. Register Now or find out more.

Don’t Ignore Dependents

Many companies don’t provide incentives for spouses and other dependents, says McCormick. That doesn’t make sense, she says, because that’s where a lot of your expense is.

In tomorrow’s Advisor, a VBBD case study, plus an introduction to a timely webinar on your 2014 Affordable Care Act obligations.

I am concerned that in the “Population by Risk Level” chart the only year that adds up to 100% is 2012. For 2010 and 2011 the risk categories add up to about 120% and 130% respectively. Of course, that appears to invalidate the claims for that client’s experience.

My previous comment may have resulted from misreading the “Population by Risk Level” chart as percentages of employees in each category. However, if read as headcount, and there is 100% employee participation as noted on the chart, the declining total number of employees suggests that the results could have been attained by the termination/retirement of high-risk employees instead of actual employee movement between risk groups.