In yesterday’s Advisor, consultant Carla McCormick offered tips for moving toward Value-Based Benefits Design (VBBD). Today, she offers a case study in VBBD plus we introduce a timely webinar on your 2014 Affordable Care Act obligations.

|

McCormick, a consultant with Fallon Benefits Group in Atlanta, made her remarks at BLR’s Advanced Employment Issues Symposium, held recently in Las Vegas.

Case Study in VBBD

Some facts about the client:

- Global presence with more the 7,000 covered lives

- Employee population includes office staff, manufacturing, and drivers

- Average employee age: 45 years

- Very low turnover

The client established the following healthcare program objectives:

- Control escalating healthcare costs without shifting costs to employees.

- Manage the impact of chronic illness proactively.

- Reduce the cost trend to a level below the market average.

- Improve or maintain the health of all plan participants.

- Foster a culture of health.

- Implement a world-class wellness program.

The program was put into place over a number of years, as follows:

|

2005 |

|

|

2006 |

|

|

2007 |

|

|

2008 |

|

|

2009 |

|

|

2010 |

|

|

2011 |

|

“I’m all set with the new health care rules.” NOT. Join us for an interactive webcast on January 21 2014 all about the Affordable Care Act and your 2014 obligations. Learn More

The Results

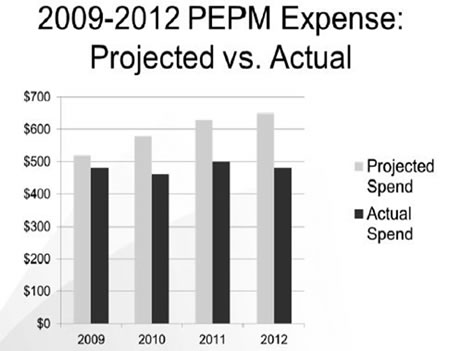

The chart speaks for itself—Per Employee Per Month (PEPM) costs are contained.

McCormick offered several more tips for those considering VBBD:

- Keep it simple. If the program is too complicated, people won’t participate.

- Honor the health culture. (Don’t, as one client did, celebrate the end of a dieting program with cake and ice cream.)

- Work with your carrier. Many carriers offer or can be talked into offering wellness programs at no cost.

- Know your numbers. Be sure that employees understand what “their numbers” (e.g., cholesterol, blood pressure, body mass index) mean.

- Don’t overestimate ROI. If you do, management will pull the plug before you have a chance to show results.

VBBD—Important to consider, but not your number one 2014 priority—for virtually all employers, dealing with the Affordable Care Act will be at the top of the to do list. Not sure what to do first? That’s easy—attend BLR’s timely webinar, Healthcare Exchanges for Employers: Legal and Practical Issues Explained.

Find out all about your 2014 obligations, plus get your specific questions answered by our expert.

Affordable Care Act 2014 obligations clarified and explained in plain English, plus1.5 hours in HRCI Recertification Credit. Register Now or find out more.

By participating in this interactive webcast, you’ll learn:

- The three types of public exchanges and how they differ from private exchanges

- Reasons why your industry matters.

- The practical impact of exchange eligibility on an individual and an employer.

- Answers to pressing questions such as whether you’re exempt from the ACA if you already offer employee benefits that include group health coverage and more.

- Whether plan renewals are likely to yield increased rates—and how much.

- What you should know about the mandated change in rating methodology concerning the small and large employer group health markets, and the cost implications the change could mean.

- How pay or play’s "50 or more full-time equivalent employees" provision impacts exchange participation.

- The penalty assessment on an employer if any full-time employee obtains tax-credit subsidized coverage through a public exchange.

- What happens if coverage is offered to 95% of full-time employees and children—and what happens when coverage is not offered to such employees or their children.

- What happens when such coverage is offered, but it either is not "affordable" or does not provide "minimum value."

- An explanation of "minimum essential group coverage," and a discussion about "minimum value" and "affordability."

- When employer-provided coverage precludes employees (and/or family members) from obtaining subsidized coverage through public exchange.

- Best practices for handling changing coverage offered from 2014 to 2015.

- What you need to know about health reimbursement accounts (HRAs) — post-employment benefits and retiree-only accounts — and flexible spending accounts (FSAs).

- The annual cap prohibition and other legal constraints of employer contributions to a healthcare exchange or other third-party coverage.

- What’s on the horizon, including insight into the 2018 effective date on the excise or "Cadillac" tax and the role private exchanges will play.

- And more!

Register now for this event risk-free.

Tuesday, January 21, 2013

1:30 p.m. to 3:00 p.m. (Eastern)

12:30 p.m. to 2:00 p.m. (Central)

11:30 p.m. to 1:00 p.m. (Mountain)

10:30 a.m. to 12:00 p.m. (Pacific)

Approved for Recertification Credit

This program has been approved for 1.5 recertification credit hours toward recertification through the Human Resource Certification Institute (HRCI).

Train Your Entire Staff

As with all BLR/HRhero webcasts:

- Train all the staff you can fit around a conference phone.

- You can get your (and their) specific phoned-in or emailed questions answered in Q&A sessions that follow each segment of the presentation.