The U.S. Department of Labor’s (DOL) Office of Federal Contract Compliance Programs (OFCCP) recently released a final rule titled “Implementing Legal Requirements Regarding the Equal Opportunity Clause’s Religious Exemption.”

Although the rule may have a short life because of the change in presidential administrations, it has the potential for far-reaching implications for federal contractors. The new regulations went into effect on January 8, 2021.

Preference for ‘Individuals of a Particular Religion’

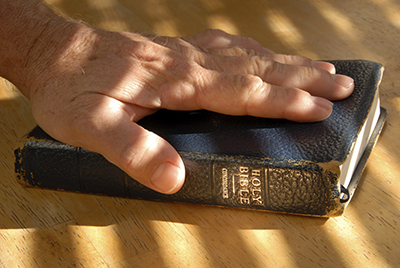

The new rule relates to Executive Order (EO) 11246, which generally prohibits federal contractors from engaging in discrimination. It also mirrors a provision in Title VII of the Civil Rights Act of 1964, however, that allows religious organizations to show a preference for “individuals of a particular religion” in keeping with the entity’s religious identity.

Thus, the primary focus of the new rule is to clarify how employers with federal contracts might claim the exemption when defending their preference for employees of a particular religion or those who observe a particular religious tenet. It provides new definitions of key terms used in the OFCCP religious exemption:

Religion. The final rule defines “religion” in a manner that is “not limited to religious belief but also includes all aspects of religious observance and practice.” Thus, employers may claim entitlement to the religious exemption because of their observances of religious practices without having to be scrutinized regarding the extent of their religious beliefs or whether the beliefs line up word-for-word with a particular religious denomination.

Religious corporation, association, educational institution, or society. The final rule abandoned an earlier proposal that only a nonprofit organization could invoke the religious exemption. Now an organization can claim the exemption if it:

- Is organized for a religious purpose;

- Holds itself out to the public as carrying out a religious purpose;

- Engages in activity consistent with and in furtherance of a religious purpose; and

- Is either a nonprofit or can present other strong evidence it has a substantially religious purpose.

The rule specifically notes “whether an organization’s engagement in activity is consistent with, and in furtherance of, its religious purpose is determined by reference to the organization’s own sincere understanding of its religious tenets.” The entity need not have a house of worship, nor must it be supported by or affiliated with a religious tradition.

Hypothetical Scenarios

To help organizations better understand the parameters, the final rule provides some hypothetical examples:

Candlestick maker. A closely held for-profit business makes and sells metal candlesticks and other decorative items. Its mission statement doesn’t address religion, but most of the company’s customers are churches and synagogues.

In addition, the federal government purchases some of its wares for diplomatic events. The company regularly confers with church leaders to ensure its products meet applicable religious specifications, runs advertisements in religious publications, and donates a portion of sales to charities run by its religious customers.

Does the business qualify for an exemption from compliance with the federal antidiscrimination laws? No, the company’s purpose is secular, not religious, as evidenced by the lack of reference to religion in its mission statement.

Moreover, the company doesn’t hold itself out to the public or its customers as a religious entity. Also, because it’s a for-profit company, it would need to satisfy a high showing to prove its religious status, which it cannot do.

Chaplains Incorporated. A nonprofit organization contracts with the federal government to provide chaplains to military and law enforcement groups around the country. The entity’s purpose as set forth in its articles of incorporation is to provide religious services to individuals of the same faith and educate others about the beliefs.

The organization regularly communicates with its employees about ways to promote the faith in the workplace, and the handbook makes several references to maintaining a “Christian atmosphere where the Spirit of the Lord can guide the organization’s work.”

Does the organization qualify for the religious exemption? Yes, according to the final rule. Clearly, the entity has a religious purpose and mission and holds itself out to employees and the public as a religious institution.

Kosher caterer. A small catering company, owned by two Hasidic Jews, specializes in kosher meals and primarily services synagogues for special community events. The federal government contracts with the company to provide kosher meals for conferences. The company’s employees aren’t exclusively Jewish, but they do receive instruction in kosher food preparation.

The company’s mission statement says it’s committed to fulfilling a religious mandate to strengthen the Jewish community by enabling its people to fully participate in public life through providing kosher meals for events. On its website, the business states it seeks to “honor G-d.” It donates to various local Jewish charitable projects, and its advertisements prominently feature Jewish imagery and text.

Does the business qualify for the religious exemption? Yes. Even though it’s a for-profit company, it clearly has a religious purpose, and its main business is providing a service in keeping with a religious practice. The company also trains its employees in certain religious practices, which are central to the service it provides.

Artifact collector. A for-profit business collects and sells religious, cultural, and archeological materials, including to the federal government, which occasionally buys items for research or decoration. Most customers are private collectors or museums. Its mission statement says its purpose is to “curate the world’s treasures to perpetuate its historic, cultural, and religious legacy.” Its marketing and advertising materials display pictures of religious artifacts as well as other cultural and artistic pieces.

Does the business qualify for the religious exemption? No, says the final rule. It isn’t a religious organization and doesn’t appear to have a religious purpose. Although it holds itself out as a company dealing in religious objects, they appear to be a minor part of the collection and don’t convey a particular religious identity overall. That’s especially true given the business is a nonprofit corporation.

Takeaways for Employers

Although the final rule provides some clarity about the religious exemption for federal contractors, its impact may be significantly curtailed by the new administration less inclined to provide leeway to religious organizations than the outgoing administration. In the interim, however, the rule sheds some light on the parameters of a highly fact-specific exemption analysis.

Laura I. Bernstein is an attorney with Felhaber Larson in Minneapolis, Minnesota. You can reach her at lbernstein@felhaber.com.