Performance Management Survey Result—How Do You Measure Up?

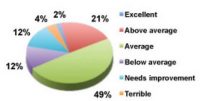

How Well Do You Measure Performance? Regarding the way their organization conducts performance appraisals, a hefty 75.2% rate their organization as average or above. Details: How well? Percent of Participants Excellent 2.1% Above average 21.9% Average 51.2% Below Average, Needs Improvement, or Terrible 24.8% What Performance Appraisals Measure Overall performance is measured by 80.7% of […]