The nearly 700 participants in this year’s edition of BLR’s 2013–2014 Pay Budget Survey show 19.2% of employers awarding merit increases of up to 2.5% in 2013 and 42.7% awarding increases of more than 2.5%, with 3.6% awarding increases above 5% of base pay.

What’s in the Survey Report?

Here’s what you’ll find in the full survey report below:

- 2013 Data

- 2014 Data

- Breakdowns by Geography and Industry

- Criteria Used to Determine Rate Range Adjustments

- Pay Practices

- Factors That Affect Salary Increases

- How the Salary Range for a New Position Is Determined

- Sources of Salary Data

- HR’s Role in Determining Raises

- Addressing Retention Problems

- 2014 Challenges

- Participants in the Survey

Here are the detailed survey results. How does your organization measure up?

HR budget cuts? Let us help. HR.BLR.com is your one-stop solution for all your HR compliance and training needs. Take a no-cost, no-obligation trial and get a complimentary copy of our special report Critical HR Recordkeeping—From Hiring to Termination. It’s yours—no matter what you decide.

2013 Merit Increases

The table below indicates merit increases by employee type.

|

2013 Merit Increases by Employee Type |

||||

|

|

No increase |

Up to 2.5% |

2.51%–5.00% |

Above 5.00% |

|

Senior management |

38.0% |

14.4% |

40.8% |

6.8% |

|

Management |

34.5% |

18.6% |

43.0% |

3.9% |

|

Nonmanagement exempt |

35.2% |

19.4% |

43.0% |

2.4% |

|

Hourly office |

36.5% |

22.3% |

38.5% |

2.7% |

|

Hourly nonoffice |

46.1% |

21.5% |

30.2% |

2.2% |

|

Average |

38.1% |

19.2% |

39.1% |

3.6% |

For a look at the maximum increase tied to a performance scale of 1–5, click here to view pdf.

2013 General Increases (not tied to performance)

General increases in 2013 are lower than merit increases with 18.6% of employers awarding (on average) up to 2.5% in 2013 and 20% awarding increases of more than 2.5%, with 2% awarding increases above 5% of base pay.

|

2013 General Increases by Employee Type |

||||

|

|

No increase |

Up to 2.5% |

2.51%–5.00% |

Above 5.00% |

|

Senior management |

63.8% |

14.5% |

21.7% |

3.8% |

|

Management |

60.8% |

18.2% |

21.0% |

2.3% |

|

Nonmanagement exempt |

61.4% |

19.0% |

19.6% |

1.1% |

|

Hourly office |

59.9% |

20.1% |

20.0% |

1.3% |

|

Hourly nonoffice |

61.5% |

21.0% |

17.5% |

1.3% |

|

Average |

61.5% |

18.6% |

18.0% |

2.0% |

2013 Maximum Individual Increases

An average of 11% awarded 2.51% to 3% as their maximum individual increase, though an average of 5.8% of survey participants awarded more than 10% of base pay. At 12.1%, nonmanagement salaried exempt employees were the largest employee group receiving the former, and at 9.1%, senior management was the largest group receiving the latter.

|

2013 Maximum Increase Awarded for Performance |

||||

|

|

No increase |

Up to 2.5% |

2.51%–5.00% |

Above 5.00% |

|

Does not meet requirements |

95.0% |

4.2% |

0.8% |

0.0% |

|

Needs improvement |

61.5% |

35.3% |

3.0% |

0.2% |

|

Meets requirements |

27.7% |

35.6% |

34.0% |

2.7% |

|

Exceeds requirements |

26.3% |

16.4% |

49.0% |

8.3% |

|

Far exceeds requirements |

29.7% |

8.9% |

43.2% |

18.2% |

|

Average |

48.0% |

20.1% |

26.0% |

5.9% |

2013 Rate Range Adjustments

On average, 22.2% of employers responding to our survey made adjustments of 2.5% or less to their exempt employee rate ranges, and 14.4% made adjustments of 2.51% to 5% to that same group. Also, 1.7% made adjustments of 5% to 10%, while 0.4% adjusted their exempt ranges by as much as 10%. A hefty 61.3% made no adjustment to exempt salary ranges in 2013.

For hourly office workers, 26% of the responding employers made rate range adjustments of 2.5% or less, and 13.7% made adjustments of 2.51% to 5%, while 1.2% increased the rate range by 5% to 10%. None made adjustments of over 10%, and 59.1% made no adjustment to their hourly office employees’ rate ranges.

A little over 23% of the responding employers made rate range adjustments of 2.5% or less to their hourly nonoffice workers, and 11.6% made adjustments of 2.51% to 5%. Rounding out this group, 1% of employers made rate range adjustments of 5% to 10%, while 0.20% made adjustments of over 10%, and 63.7% made no adjustment to their hourly nonoffice rate ranges.

2013 Biggest Challenge

When asked to describe their biggest challenge in determining 2013 salary increases, 46% of survey participants cited budget constraints as the issue. Myriad other challenges were also noted, including:

- Inconsistency in ranking/rating employees, 8%

- Economic uncertainty, 7%

- Finding comparable data, 7%

- Maintaining competitiveness, 6%

- Inability to reward top performers, 3%

- Healthcare reform and/or taxes, 3%

- Getting senior management buy-in, 2%

- Union contracts/negotiations, 2%

- Determining a pool amount, 2%

- Determining increase guidelines, 2%

2013 Bonuses

While 7.3% of survey respondents offered bonuses in lieu of raises, 41.9% paid bonuses in addition to salary increases, and 19.3% awarded both bonuses and increases to their employees in 2013.

On average, 46.8% paid bonuses to their exempt employees in 2013, with 16% offering amounts of 5% or less and 30.8% awarding amounts of greater than 5%. In comparison, 32.9% of those surveyed awarded bonuses to their hourly office workers, with 23% offering 5% or less and 9.9% awarding amounts greater than 5%. Hourly nonoffice workers were awarded bonuses by 26.4%, with 20.7% offering 5% or less and 5.7% awarding amounts greater than 5%.

|

2013 Bonus Amounts by Employee Type |

||||

|

|

No Bonus |

Up to 5% |

5.01%–10.00% |

Above 10.00% |

|

Senior management |

47.5% |

12.2% |

9.9% |

30.4% |

|

Management |

50.4% |

16.6% |

12.6% |

20.4% |

|

Nonmanagement exempt |

61.9% |

19.2% |

11.9% |

7.0% |

|

Hourly office |

67.2% |

23.0% |

7.5% |

2.4% |

|

Hourly nonoffice |

73.6% |

20.7% |

4.5% |

1.2% |

|

Average |

60.1% |

18.3% |

9.3% |

12.3% |

|

Criteria for How 2013 Bonus Amounts Were Paid |

|

|

Individual performance |

44.1% |

|

Company profits |

41.4% |

|

Company performance against budget |

36.1% |

|

Other |

22.5% |

|

Combined individual performance and across the board |

21.9% |

|

Across the board |

9.7% |

2014 Merit Increases

A mere 14.1% of survey participants have decided and/or approved their pay budgets for 2014, leaving 85.9% undecided as of the end of June.

Of those who have decided, on average across all employee types, 17.8% of the employers expect to offer 2014 merit increases of up to 2.5%, 49% plan no increase, 29.6% plan to offer merit increases of 2.5% to 5%, and 3.5% plan to offer increases above 5%.

|

2014 Merit Increases by Employee Type |

||||

|

|

No increase |

Up to 2.5% |

2.51%–5.00% |

Above 5.00% |

|

Senior management |

47.5% |

16.3% |

31.3% |

5.0% |

|

Management |

48.8% |

16.3% |

31.3% |

3.8% |

|

Nonmanagement exempt |

47.5% |

17.5% |

31.3% |

3.8% |

|

Hourly office |

48.8% |

20.0% |

28.8% |

2.5% |

|

Hourly nonoffice |

52.6% |

19.2% |

25.6% |

2.6% |

|

Average |

49.0% |

17.8% |

29.6% |

3.5% |

2014 General Increases

Of those who have decided their pay budget for 2014, on average across all employee types, 22.2% of the employers expect to award general increases of up to 2.5%, 56.5% plan no general increase, 17.2% plan to offer general increases of 2.5% to 5%, and 4.2% plan to award above 5%.

|

2014 General Increases by Employee Type |

||||

|

|

No increase |

Up to 2.5% |

2.51%–5.00% |

Above 5.00% |

|

Senior management |

58.2% |

17.7% |

19.0% |

5.1% |

|

Management |

57.1% |

20.8% |

18.2% |

3.9% |

|

Nonmanagement exempt |

52.6% |

25.0% |

18.4% |

3.9% |

|

Hourly office |

55.8% |

24.7% |

15.6% |

3.9% |

|

Hourly nonoffice |

58.7% |

22.7% |

14.7% |

4.0% |

|

Average |

56.5% |

22.2% |

17.2% |

4.2% |

2014 Maximum Individual Increases

Approximately 11% of survey participants indicated their plans for maximum individual increases in 2014. Of that group, on average, 24.3% plan to award a maximum of 2.5%, and 32.5% plan a maximum of 2.51% to 3% as their individual increase, while an average of 11.9% plan more than 5% of base pay. At 13.3%, nonmanagement salaried exempt employees are the largest employee group receiving individual increases of more than 5%.

2014 Rate Range Adjustments

Of the 10.5% of survey participants that answered the question, 61.9% plan no rate range adjustments for 2014, 19.5% expect to adjust their rate ranges by up to 2.5%, 16.1% expect to make adjustments of 2.51% to 5%, and 2.5% plan adjustments of more than 5%.

|

2014 Bonuses

A little over 10% of those responding to our survey provided information regarding their plans for bonuses in 2014. Of those who did, on average, 7.4% plan to offer bonuses of up to 2.5% of base pay, and 5.5% plan to offer 2.5% to 5%. Another 3.3% plan bonus amounts in 2014 of 5.01% to 10%, and bonus amounts of over 10% are planned for an average of 10.9% of the survey participants who answered this question.

Though 7.9% plan to award bonuses in lieu of pay increases, 34% will award bonuses in addition to salary increases, and 17.5% plan to award both bonuses and raises in 2014.

|

2014 Bonus Amounts by Employee Type |

||||

|

|

No Bonus |

Up to 5% |

5.01%–10.00% |

Above 10.00% |

|

Senior management |

65.8% |

9.6% |

1.4% |

23.3% |

|

Management |

68.5% |

9.6% |

4.1% |

17.8% |

|

Nonmanagement exempt |

71.6% |

13.6% |

5.4% |

9.5% |

|

Hourly office |

76.7% |

17.8% |

2.7% |

2.7% |

|

Hourly nonoffice |

81.9% |

13.9% |

2.8% |

1.4% |

|

Average |

72.9% |

12.9% |

3.3% |

10.9% |

Geographic and Industry breakdowns

Click image to view full size.

Click image to view full size.

Pay Practices

The most important factors that affect pay increases include performance (77%), company profits (60.6%), and competitors’ wage rates (39.7%). Coming in at 7.3%, seniority is the least common factor affecting raises.

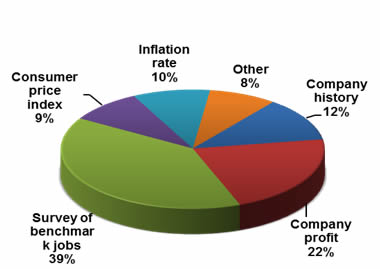

The criteria our survey participants use to determine rate range adjustments include survey of benchmark jobs (69.5%), company profit (38.4%), and company history (21.2%).

|

Factors That Affect Salary Increases |

|

|

Merit/Performance |

77.0% |

|

Company profits |

60.6% |

|

Competitors’ wage rates |

39.7% |

|

Approval of Board of Directors |

33.4% |

|

Job classification |

17.7% |

|

Other |

15.9% |

|

Approval of government board, commission, legislature, etc. |

10.9% |

|

Department or division |

7.7% |

|

Seniority |

7.3% |

When it comes to assigning a salary range for a new position, our survey participants use a variety of methods:

|

How the Salary Range for a New Position Is Determined |

|

|

Compare against similar positions within the organization |

71.5% |

|

Research location, industry, and position salary data |

62.3% |

|

Research local job market |

56.7% |

|

Participate in salary surveys to obtain data for similar position with the area/industry |

52.0% |

|

Research competitor wages |

40.6% |

|

Rank position within the organization |

32.2% |

|

Consider chosen applicant’s previous salary |

25.1% |

|

Other |

5.4% |

Sources of Salary Data

Our survey participants use a wide range of sources for salary data, including:

- Trade associations (47.3%)

- Bureau of Labor Statistics (44.5%)

- Salary.com (37.3%)

- Consultants (32.6%)

- Other (30.6%)

- BLR (25.1%)

- Online recruiters (17.4%)

- Economic Research Institute (17.2%)

- O-Net Online (8.9%)

HR’s Role in Determining Raises

HR professionals fulfill many roles when it comes to setting raises. For example, 50.2% of our survey participants who answered this question help supervisors with tough pay decisions, and 48.5% play a major role in deciding the companywide level for raises. Each department’s raises are reviewed by 38.5%, and 25.2% approve each employee’s salary increase. Employee raises are determined by 9.3%, and 20.9% play no role in setting raises at their organization.

|

HR’s Role in Setting Raises |

|

|

Helps supervisors with tough pay decisions |

50.2% |

|

Plays a major role in deciding the companywide level for raises |

48.5% |

|

Reviews each department’s raises |

38.5% |

|

Approves each employee’s raise |

25.2% |

|

Plays no role in setting raises |

20.9% |

|

Reviews individual raises, but no veto power |

20.8% |

|

Sets pool amounts given to managers to use at their discretion |

19.4% |

|

Other |

9.8% |

|

Determines each employee’s raise |

9.3% |

Addressing Retention Problems

To address employee retention problems, 61.8% evaluate their pay scale/rate range levels to ensure market competitiveness, and 44.8% evaluate employees for flight risk, addressing pay issues at the individual employee level. No compensation-related problems are the norm for 17.9% of survey participants.

2014 Challenges

The wage-related issues survey participants expect to have at the end of 2014 include trying to keep up with competitors’ wage rates for 27% and dealing with budget constraints for 24%. Another 12% expect that retaining employees who are still receiving low pay may be a concern. The impact of the Affordable Care Act and rising benefits costs will be an issue for 13%, and maintaining company profitability is an important issue for 7%. An uncertain economy continues to be an issue for 4%, and achieving internal equity is a concern for 5%.

One survey participant commented that continued growth of the local market economy drives up employer costs (benefits, wages, etc.), while wages are driven by national averages (Social Security, CPI, etc.), and the disconnection between the two is a killer for a not-for-profit services provider.

Participants in the Survey

A total of 696 organizations participated in this survey, which was conducted in June 2013. Of those who identified themselves, 47.9% are privately owned, 8.9% are public entities, 29.1% are government or nonprofits, and 3% are employee-owned organizations.

Fewer than 7% of the employers surveyed have a 50% to 100% unionized workforce. Also, 84.3% have a workforce that is less than 10% union employees.

Less than 29% of the respondents have a workforce of more than 50% exempt employees.

Over half (54.8%) of the participants are in service industries; 20.8% are in agriculture, forestry, construction, manufacturing, or mining; 6.5% are in wholesale, retail, transportation, or warehousing; and 17.8% are in real estate, utilities, or “other.”

Comp and benefits professionals account for 15.6% of the survey participants who self-identified, other human resources professionals make up 67.9%, and 16.5% are in other areas with HR responsibilities.

Thanks to all who participated!