Category: Benefits and Compensation

This topic provides guidance on how to handle compensation issues in a way that attracts and retains the best talent and advances the strategic goals of your business. You get news and tips on what’s going on nationally and in the states, and updates on changes in regulations, possible governmental action, and emerging compensation trends.

Tax Consequences of Bonuses Bonuses paid in consideration for services rendered are almost always taxable wages subject to income tax withholding, FICA, and FUTA. These include production, incentive, and nondeferred profit sharing bonuses. The Internal Revenue Service has also ruled that bonuses paid to employees for signing or ratifying an employment contract are considered wages […]

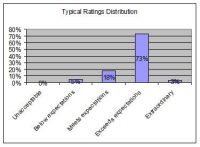

Green, who is a principal at consultant Hay Group, offered her tips at a recent webinar sponsored by HRHero/BLR. What Pay-for-Performance Is (And Isn’t) First, says Green, it’s important to clarify what is pay for performance and what isn’t. Pay for performance, she says is: Any type of compensation or reward that is provided only […]

Bonuses are an integral part of many companies’ compensation packages because they: Are an expression of goodwill from employer to employee. Exemplify a personal touch and may evoke loyalty and dedication. Allow organizations to manage pay for performance Can be used as an incentive to retain top performers or to attract new employees Allow the […]

Segal, a partner with Duane Morris law firm in Philadelphia, shared his expertise at SHRM’s Employment Law and Legislative Conference, held recently in Washington, DC. [Go here for tips 1 through 13] 14. Focus on Risk Selection, Not Risk Avoidance In 2012, there’s no avoiding risk, says Segal. For example, say there’s a hiring decision […]

Segal, a partner with Duane Morris law firm in Philadelphia, offered his tips for dealing with the C-suite at SHRM’s Employment Law and Legislative Conference, held recently in Washington, DC. 1. Stop Asking To Be At Table Asking only reinforces the perception of your subordinate role, Segal says. Instead, demonstrate why you should be at […]

Experts Terry Pasteris and Mark Lipis have an answer, but first, the rest of their focal points for 2012 from yesterday’s Advisor. (Pasteris is president of TLMP Consulting Group and Lipis is owner of Lipis Consulting Inc.) 2012 Focal Points for Private Companies Here’s what Lipis and Pasteris suggest you consider for 2012: IRS’s continued […]

Pasteris is president of TLMP Consulting Group and Lipis is owner of Lipis Consulting Inc. Focal points: All Companies Since for most companies there’s not a lot of money to go around, the question is, how do you get the best bang for the buck? Here’s what WorldatWork’s 2012 survey projects: Actual 2010 Actual 2011 […]

Preparing Staff to Handle Questions/Concerns Preparing staff to handle participant questions and concerns is of paramount importance because ineffective answers can lead to mistrust, morale issues, and compliance scrutiny. It may even lead to legal challenges under ERISA. To avoid these problems, prepare supervisors and staff. Invite your investment advisor or a representative of the […]

The California Employment Law Letter (CELL). is written by Mark I. Schickman, and Cathleen S. Yonahara, both attorneys at the law firm of Freeland Cooper & Foreman LLP in San Francisco. Defining Essential Job Functions Most employers use some form of job description, but many are cumbersome documents that have little practical value because they’re […]