Many employers in Canada are assessing how they can continue to compete during the tough financial times that appear to be heading toward us. One of the most difficult decisions employers must make is how to reorganize or reduce labor costs in order to stay competitive.

While closures and layoffs make sense for some employers, other employers are questioning whether other options are available to them. What options do companies have in tough economic times to reduce labor costs?

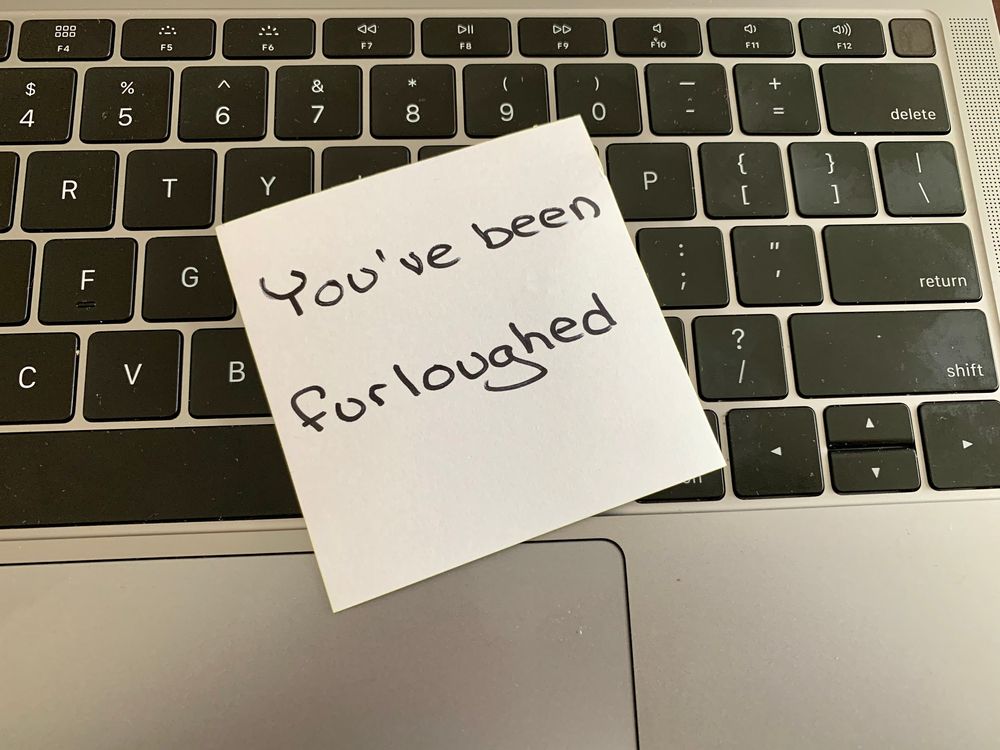

One way is to spread the pain among the workforce instead of among a few employees. Among the lessons that Canadian employers are taking from their American counterparts is to grant furloughs for workers during tough economic times.

What is a furlough? While the word is often associated with permission to take a leave of absence from the military or a brief release from prison, it is increasingly applied within the employment context. In this context, furlough generally refers to a short-term rolling layoff. A furlough differs from a normal temporary layoff in that employees continue to work on a fairly constant and regular basis, but employers schedule the employees to have certain days off.

The benefits of a furlough are obvious: In the short term, an employer can reduce payroll costs while maintaining its full roster of workers; in the long-term, and especially when the labor market becomes competitive, employers also garner the recruitment and retention benefits associated with having been more committed to their labor force. For junior workers, more of them are able to remain employed.

Furloughs can be structured in a variety of ways. Regardless of the structure used, you need to be mindful of any terms of any existing union agreement. Where a union agreement does not exist, employers must in any event operate within the basic terms and conditions of the employment relationship so as to avoid triggering claims for constructive dismissal by employees.

While there is little case law relating to furloughs, some of the principles surrounding layoffs and constructive dismissal are instructive. In one of the leading cases, Stolze v Addario (1997), the Ontario Court of Appeal was asked to determine whether a layoff was, in fact, a constructive dismissal. The court determined that the employee’s contract did not contemplate a layoff (whether temporary or permanent) and therefore, the employee was improperly terminated. Stolze therefore suggests that, unless a salaried employee’s contract specifically contemplates a furlough (or layoff), an employee could be successful claiming constructive dismissal if an employer institutes a furlough.

If you are an employer considering using furloughs, here are some key considerations:

- Do not think of a furlough as a layoff in the usual sense contemplated in employment standards legislation; a furlough is for a short time period and should not be used to provide long-term cost relief in declining industries.

- Be as transparent as possible with your employees: Explain to your employees what a furlough is and what a furlough is not; you want your employees to have a clear understanding that they are still expected to report to work on scheduled days and that this is a temporary arrangement.

- Secure agreement from your nonunion employees to proceed with a furlough; this will help prevent future constructive dismissal claims.

- If you are a unionized employer, check your collective agreement to determine if a furlough is permissible. If in doubt, meet with the union to obtain its agreement if possible.

- Be aware that the federal agency, Service Canada has a Work-Sharing Program that offers benefits to workers involved in a furlough program. The program must meet the conditions set out by Service Canada. The Work-Sharing Program grants qualifying employees affected by temporary work reductions up to 55 percent of their maximum yearly insurable earnings for a period of between six and 26 weeks.

I am curious if furloughed employees have the right to work elsewhere on furlough days, as is the case under US labour law. The idea is that although the furlough is temporary, one has the right to mitigate income losses due to the furlough. Many employers do not permit you to work in another capacity under normal course of business, which is reasonable, especially if one is a professional, but in the case of a furlough, one is no longer being paid for that time, so it would also seem reasonable to be allowed some reprieve from this restriction (unless perhaps the alternative employment was with a direct competitor or regular client thus violating ongoing independence considerations).