Base executive pay decisions on total direct compensation and you are likely to “miss the market by a mile,” says consultant Kurt Fichthorn.

To understand the importance of a total remuneration perspective, look at this table that reflects information about your CEO’s compensation, says Fichthorn, vice president in the Philadelphia office of Hay Group.

CEO Compensation Comparison—Total Direct Compensation

|

|

Marketplace Median |

President, XYZ Corp. |

% of Median |

|

Base Salary |

$642,600 |

$949,000 |

148% |

|

Total Target Cash |

$1,099,100 |

$1,328,600 |

121% |

|

LTI Present Value |

$931,800 |

$259,250 |

28% |

|

Total Direct Comp |

$2,030,900 |

$1,587,850 |

78% |

If this analysis stopped here at a total direct comp level, you’d get the impression that the CEO of XYZ Corp. is underpaid when compared to his or her peers. But that would be an inappropriate conclusion, Fichthorn says. Look at the table below, which adds information about the value of benefits to the chart:

CEO Compensation Comparison—Total Compensation and Benefits

|

Compensation Component |

Marketplace Median |

President, XYZ Corp. |

% of Median |

|

Base Salary |

$642,600 |

$949,000 |

148% |

|

Total Target Cash |

$1,099,100 |

$1,328,600 |

121% |

|

LTI Present Value |

$931,800 |

$259,250 |

28% |

|

Total Direct Comp |

$2,030,900 |

$1,587,850 |

78% |

|

Benefit Total Value |

$207,829 |

$653,136 |

314% |

|

Total Remuneration |

$2,238,729 |

$2,240,986 |

100% |

Now we see the true picture, says Fichthorn, which is that the CEO of XYZ Corp. is paid right at the median of his or her peers.

What Are the Latest Trends in Executive Benefits?

The executive benefits landscape has changed over the past several years for a number of reasons, says Fichthorn:

- Struggling national and global economies

- Declining share prices

- Expanded proxy disclosures

- Intense public focus on executive benefits and compensation, both in the media and through Say on Pay

How can organizations best attract and retain executives in this environment? Organizations, both not for profit and for profit, must focus on the level and composition of executive benefit programs.

Organizations must also balance market-competitive considerations with shareholder and/or public interests.

Survey Pins Down Exec Pay Practices

A recent Hay Survey sought to obtain current data on the prevalence of practices regarding executive retirement and perquisites for employers of all sizes and across a broad group of industries, Fichthorn says.

There were 317 respondents from 8 industry classifications with revenues ranging from less than $50M to more than $20B.

Managing an HR Department of One was recently recognized as one of SHRMStore’s “Great 8” best-selling products. Examine it at no cost or risk for 30 days and find out what all the buzz is about.

Executive Retirement Plans

In aggregate, nearly half of the participating organizations provide some type of nonqualified retirement plan, either defined benefit or defined contribution.

The market is evenly split between defined benefit and defined contribution programs; however, new programs are typically defined contribution, Fichthorn says.

Why Organizations Use Nonqualified Retirement Plans

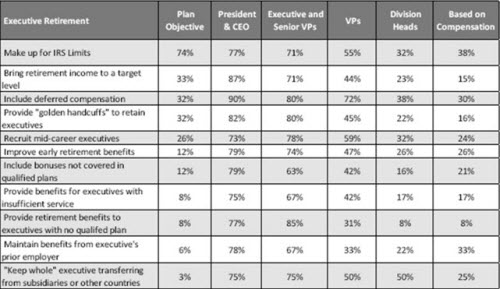

Organizations most often use nonqualified retirement programs to make up for IRS limits, says Fichthorn. The table below indicates percentages of respondents to the Hay Survey that indicated the various reasons for using nonqualified retirement plans, broken out by job level.

Other findings related to nonqualified retirement plans include the following:

Funding Retirement Plans

- 52% of respondents informally fund their nonqualified retirement programs.

- Rabbi trust is the most prevalent in the general market.

Vesting Retirement Plans

- 16% have immediate vesting.

- 40% have service-based cliff vesting.

- 20% have age-based cliff vesting.

- 17% have graded vesting.

Feel as if you’re all alone in HR? Take on a partner—Managing an HR Department of One. Examine it at no cost or risk for 30 days. Get more information.

Most Common Perquisites for Executives

Perquisites continue to be part of executive compensation packages; however, the level and mix demonstrate the impact of regulation and public scrutiny, Fichthorn says.

|

Executive Perquisite |

Offered |

President & CEO |

Execu- |

VPs |

Division Heads |

Based on Com-pen-sation |

|

Cellular Phones |

79% |

94% |

87% |

83% |

67% |

9% |

|

Exec Severance Pay Practice |

51% |

87% |

80% |

58% |

29% |

8% |

|

Employ- |

48% |

19% |

55% |

23% |

13% |

8% |

|

Exec Physical Exams |

43% |

96% |

85% |

55% |

20% |

4% |

|

Golden Parachutes |

42% |

92% |

83% |

31% |

13% |

7% |

|

Exec Parking |

39% |

95% |

83% |

56% |

27% |

1% |

|

Exec Group Life Insurance |

37% |

88% |

80% |

57% |

22% |

10% |

|

Exec LTD |

37% |

84% |

80% |

60% |

26% |

22% |

|

Car Allowance |

36% |

78% |

71% |

56% |

34% |

4% |

|

Average Car Allowance Amount |

— |

$11,988 |

$10,921 |

$10,376 |

$11,187 |

$7,667 |

|

Personal Financial Coun-seling/Tax Prep |

31% |

95% |

82% |

40% |

19% |

6% |

|

Company Cars |

30% |

93% |

57% |

38% |

24% |

4% |

Only 18% of organizations gross up any perquisites provided, with car allowance the most commonly grossed up benefit, Fichthorn says.

In tomorrow’s Advisor, the public’s breaking point on exec comp, plus an introduction to the only guide written especially for smaller or even one-person HR departments.

I can’t imagine a competent compensation professional who wouldn’t consider CEO benefits when evaluating a compensation package. In larger corporations, it’s not unusual for loosely defined “benefits” to exceed direct comp.