Along with its requirements for paid leave and unemployment insurance, the Families First Coronavirus Response Act (FFCRA, H.R. 6201) also imposes new coverage requirements on group health plans that relate to the coronavirus (COVID-19) pandemic.

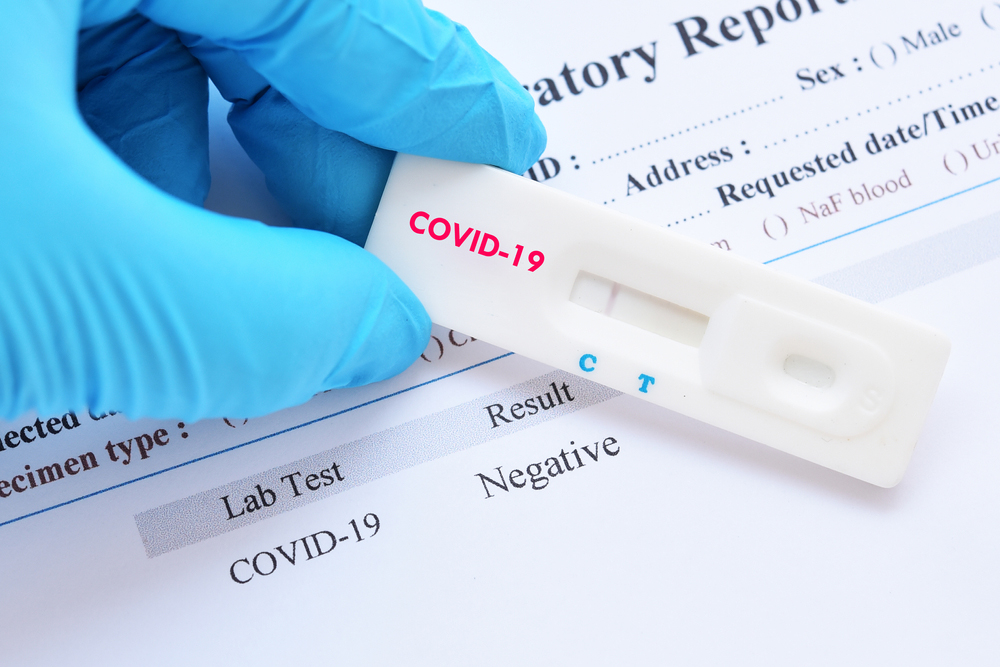

Section 6001 of the FFCRA, signed March 18, requires both health insurers and self-funded plans to cover approved COVID-19 testing products and their administration without imposing any cost sharing, prior authorization, or other medical management requirements. The mandate applies even to plans grandfathered under the Affordable Care Act.

The mandate also applies to “items and services furnished to an individual” during visits to a healthcare provider, urgent care center, or emergency room that result in a COVID-19 test, to the extent the item or service relates to administering the test or evaluating the need for it. A healthcare provider office visit is defined to include both in-person and telehealth visits.

The U.S. Departments of Labor, Health and Human Services, and the Treasury are empowered to enforce these requirements as if they were included in the corresponding benefits law (such as the Employee Retirement Income Security Act, for group health plans). Subsequent sections of the FFCRA require the Medicare, Medicaid, and other programs to provide similar coverage.

The FFCRA does not specify whether the requirement extends to out-of-network services. It likely does, however, because the circumstances of testing are often rerouting patients from their usual treatment settings, according to Ben Conley of Seyfarth Shaw.

For high-deductible health plans (HDHPs), the Internal Revenue Service previously provided “welcome relief” in guidance clarifying that first-dollar coverage of COVID-19 testing or treatment will not jeopardize HDHP status for purposes of health savings account eligibility, Conley noted in a March 23 webinar. However, it is unclear that the same would apply to first-dollar coverage of telemedicine more generally, although some plans are doing so anyway.

The FFCRA takes effect April 1. More changes are likely in this area as a result of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act).