The U.S. Department of Labor’s (DOL) announcement of plans to rescind final rules related to independent contractors and joint employers should put employers on notice that a less employer-friendly day is coming, attorneys who advise employers say.

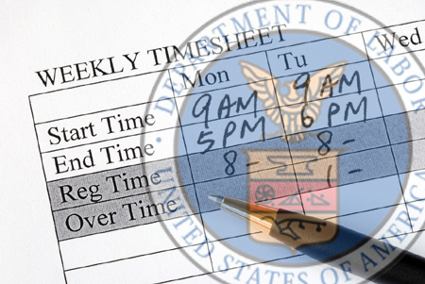

In announcing the effort on March 11, the DOL said the action is needed because the rules weaken protections for workers under the Fair Labor Standards Act (FLSA), which guarantees a minimum wage and overtime pay for workers classified as employees. Workers classified as independent contractors don’t fall under the FLSA’s protections.

The rules targeted are the Trump administration’s independent contractor final rule, which was announced in the last days of the Trump administration but has not yet taken effect, and the joint employer relationships under the FLSA final rule, which took effect on March 16, 2020.

Independent Contractor Rule

The Biden administration DOL objects to a new “economic reality” test set out in the Trump administration rule to determine whether a worker is an employee or an independent contractor under the FLSA.

Paul J. Sweeney, an attorney with Coughlin & Gerhart, LLP, in Binghamton, New York, says the Trump administration’s business-friendly rule uses an “economic reality test centered around the degree of control over the work performed and the worker’s opportunity for profit or loss.”

The current DOL proposal doesn’t provide guidance on what would replace the Trump administration rule. “However, it is expected that, based on past campaign promises, the Biden DOL will rapidly propose reverting to the ABC test that allows for ‘indirect control,’ which could result in the reclassification of many independent contractors as employees, making them eligible for overtime and protection under a state’s wage and hour, antidiscrimination, and safety laws,” Sweeney says.

Under the ABC test, a worker is an employee instead of an independent contractor unless the hiring entity demonstrates that all the following conditions are satisfied. The worker must:

- Be free from the company’s control and direction in connection with the performance of the work;

- Perform work that is outside the usual course of the hiring entity’s business; and

- Be customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

Burton J. Fishman, an attorney with FortneyScott in Washington, D.C., says employers should expect a renewed version of the independent contractor regimen seen during the Obama administration. At a minimum, he says, it will be harder to characterize workers as contractors.

Joint Employment Rule

Fishman says employers should expect a renewed version of the Obama administration’s regimen on joint employment, which will make it harder for employers to avoid joint employment relationships. Franchisors will be a particular target, he says.

The National Labor Relations Board (NLRB) has regulations interpreting what constitutes joint employment under the National Labor Relations Act, and the DOL has regulations interpreting joint employment under the FLSA. Fishman points out that the DOL can’t rescind or alter NLRB regulations, and they are “certain to conflict” with a new rule from the Biden administration’s DOL.

Sweeney says a new DOL rule is expected to “borrow heavily” from the joint employer test articulated in the Obama-era NLRB decision Browning-Ferris Industries of California, Inc. That decision held a business will be considered a joint employer when it exhibits not just direct control but also indirect control or the ability to exert control over employees.

“Expansion of the joint employer definition would have profound impacts due to labor’s past efforts to organize the transportation and ‘gig’ service sectors,” Sweeney says, adding that national franchisors also can expect renewed exposure.

Advice for Employers

Sweeney says employers should remain flexible but assume a “rapid and aggressive return to Obama-era DOL rules, guidance, and enforcement that favors employees and unions.”

“If a business model was based on a Trump-era DOL rule with respect to the use of independent contractors, now is the time to reconsider those assumptions,” Sweeney says. “Potential joint employers should anticipate labor’s organizational efforts and be prepared to defend and respond.”

Fishman says no new rules will go on the books for a while, but employers should prepare to deal with a DOL opinion letter or some interim advisory reinstituting much of the Obama doctrine.

Fishman advises shoring up contracts with independent contractors and clarifying lines of authority with franchisors regarding possible joint employer claims. “Pretend it’s 2015,” he says.

Tammy Binford writes and edits news alerts and newsletter articles on labor and employment law topics for BLR web and print publications.