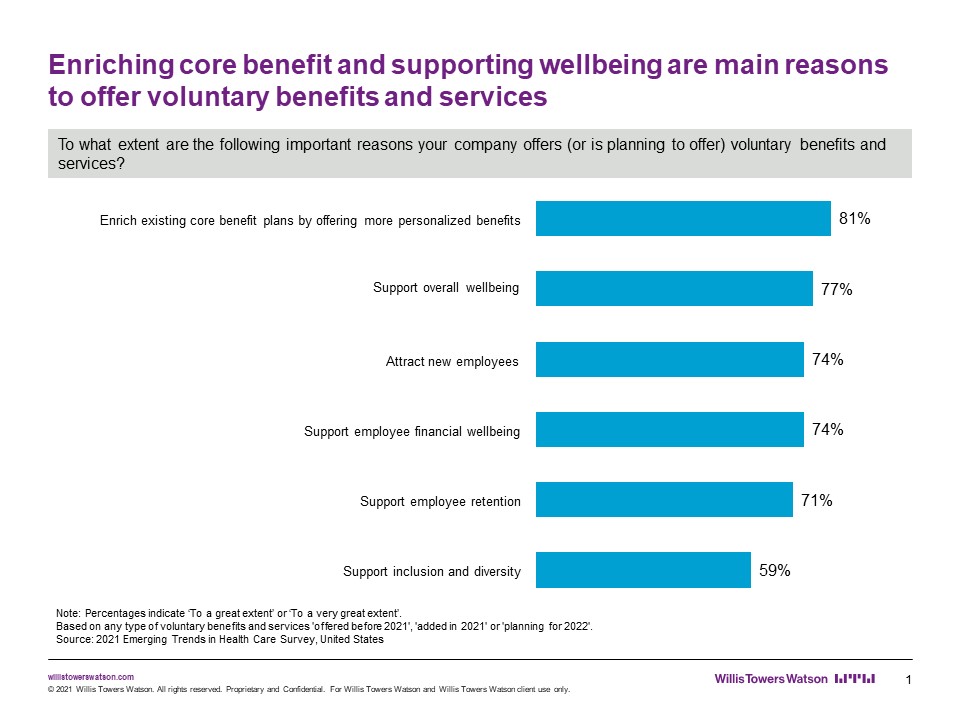

As a consultant who feels strongly about providing employees with both choice and value in their overall benefits package, I am heartened to see that employers increasingly see voluntary benefits as a means of enriching their core benefits plan by allowing employees to choose more personalized benefits.

However, it is important to focus on providing employees with meaningful choice, as well as value. And with employers looking to recruit experienced talent, offering options that appeal to multiple ages and family types can help make these companies employers of choice.

Recently, a midsize manufacturer and I spoke about how voluntary benefits could have helped an employee with a significant health situation. We did the math, looking at deductibles, coinsurance, and out-of-pocket (OOP) maximums, as well as potential voluntary benefits payouts. Our analysis showed that the employee could have fully covered OOP costs, with a modest amount remaining to spend for complementary care or supplemental disability insurance. The organization found the contribution of voluntary benefits to be compelling as it designed its benefit plan.

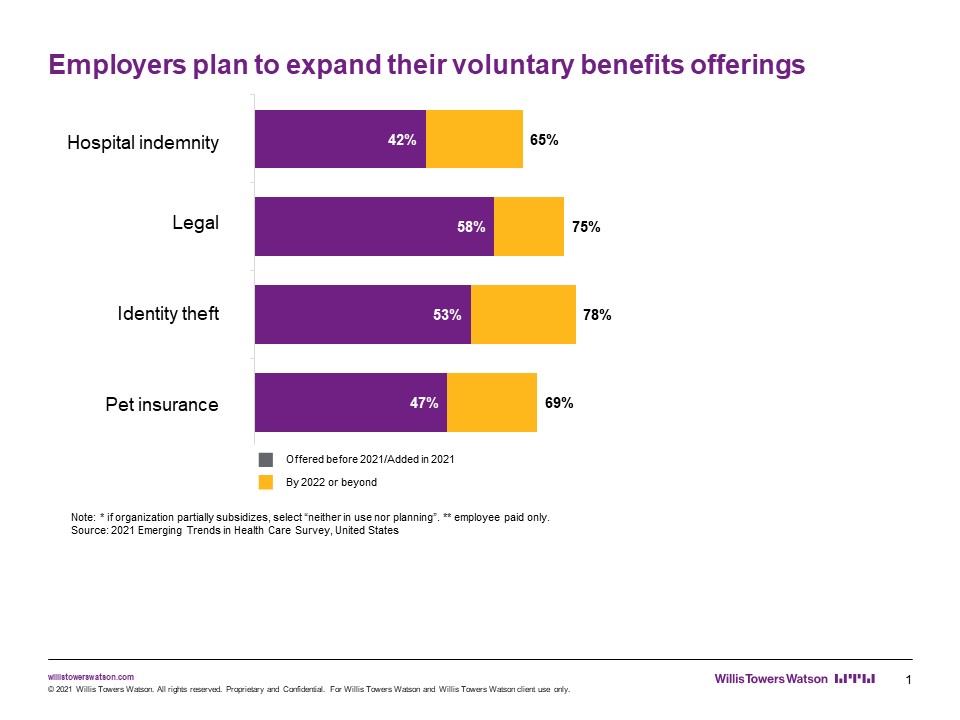

Plans to Expand Voluntary Benefits

Voluntary benefits come in a variety of flavors that can complement traditional benefit offerings and appeal to employees in many cohorts.

(yellow bars in chart highlight most significant anticipated growth)

For example, hospital indemnity is a fast-growing benefit due to its appeal to growing families who see its value in helping to offset maternity expenses that are not fully covered by the medical plan. Supplemental medical coverage such as hospital indemnity is not coordinated with medical coverage, and because premiums are paid with post-tax dollars, the benefits are nontaxable. This means employees can use the dollars as they see fit—to offset deductibles and coinsurance, to pay for complementary services such as child care, or even to pay for diapers!

At the other end of the spectrum, pet insurance has special appeal for both empty nesters and employees who don’t yet have human children of their own, as well as, of course, families with children and pets. Plans can cover both sickness and accidents for Fido or Fluffy, as well as routine exams and vaccinations, and coverage can be tailored to meet specific needs. Historically, pet coverage had exclusions for certain conditions for certain breeds (think hip issues for labs or breathing issues for pugs), but we are seeing that coverage is being simplified with far fewer exclusions. Interest in pet insurance has expanded significantly during COVID, and we see it as a great attraction and retention tool for employers.

In the middle, legal coverage and identity theft protection have appeal to employees across the board—whether signing their first lease or purchasing a house or developing a will or trust, legal coverage can have meaningful value. Moreover, identity theft has become rampant in recent months, with significant increases in both tax and unemployment fraud. Unlike with some supplemental medical coverage, these plans are intended to be used more actively.

Outside of accessing a wellness benefit for a health screening, no one really wants to use an accident or a critical illness plan. On the other hand, employees should actively leverage legal plans to implement or revise wills and trust documents. They can also proactively use the service for document review if purchasing a house. Of course, it also comes in handy for speeding tickets, etc.

Similarly, identity theft coverage, while foremost designed to help employees who have their identities stolen, can be used proactively. Plans provide access to credit scores, as well as to regular credit reports, so that individuals can monitor what appears on their reports and respond quickly to inaccuracies.

Another benefit that has received a lot of client and employee interest recently is education benefits, including student loan repayment, tuition reimbursement, etc. While many people initially think of these as benefiting younger hires, the reality is that employees across the board can benefit from a robust education benefit package that can include student loan assistance, tuition reimbursement, college coaching, 529 access, and training and scholarship programs.

Many new hires look for education benefits—in the form of either helping them pay down debt or helping to further their education—as they consider job offers. (Perhaps their parents do, too!) While programs that provide direct employer dollars to help pay down debt can be challenging from a budget perspective, other programs can provide real value to employees and their families at a much more modest price point. For example, college coaching programs can help employees’ children make informed decisions about college. Additionally, 529 plans that facilitate employee contributions to tax-preferred accounts to pay for a child’s education are low cost and high value.

Assessing Benefit Offerings

As employers assess their talent needs for their new ways of working, it is wise to consider benefit offerings that will most appeal both to candidates they seek to attract and to existing employees they seek to retain. Potential questions an employer may ask:

- Do the employees we are looking to hire have the same benefits needs as my current employees?

- Are family structures different?

- How may these benefits impact different areas of well-being?

- Are there gaps in our current offering that I can look to fill right now?

- How can we round out both an inclusive and a diverse benefits package?

Lydia Jilek is Senior Director for Voluntary Benefits Solutions at Willis Towers Watson, a global advisory, broking, and solutions company.