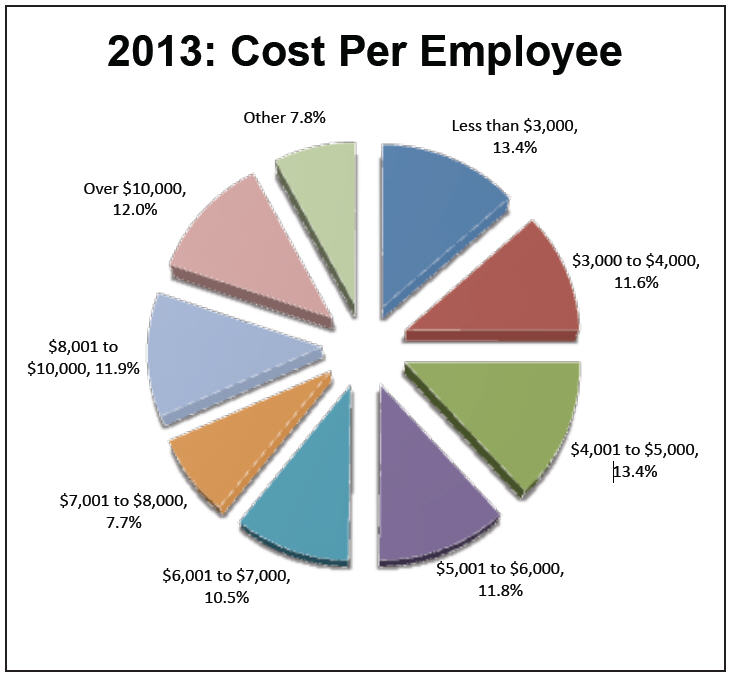

- Wide range of costs per employee ranging from under $3,000 to over $10,000 per year

- 22 percent still cover 100% of insurance costs; an additional 46% cover at least 75 percent of costs

- 25% have considered dropping health benefits as a result of Affordable Care Act

Here are the detailed survey results. How does your organization measure up?

2013 vs. 2012

When asked how their health insurance package for 2013 compares to their 2012 package, 73% of survey participants indicated it is about the same, though 6% have a more generous package. Their 2013 package is less generous than last year for 15% of respondents. The “other” response was selected by 4%, and 2% “weren’t sure.”

Compensation.BLR.com, now thoroughly revamped with easier navigation and more complete compensation information, will tell you what’s being paid right in your state—or even metropolitan area—for hundreds of jobs. Try it at no cost and get a complimentary special report. Read more.

Plan options

| Type of Plan |

Percent Offering |

|

|

|

|

PPOs are offered |

68% |

|

|

|

|

HMOs are offered |

31%. |

|

|

|

|

High deductible plans |

35% |

|

|

|

|

Point-of-service plans |

13%. |

|

|

|

|

Traditional indemnity plans |

5%. |

|

|

|

|

Other |

6% |

|

|

|

Offering high deductible plans has been considered by 44% of survey participants, leaving 40% that haven’t considered it, 13% that don’t know if they have or not, and 2% in the “other” basket.

FSAs (flexible spending accounts)

The following percentages of employers offer FSAs:

- 51% for childcare

- 12% for eldercare

- 58% for health care

- 2% for disability insurance

A two-and-a-half-month grace period for reimbursements is offered by 71% of respondents.

Cost Per Employee

The chart shows costs per employee ranging up over $10,000 for 12% of respondents.

Unmarried and Same-Sex Partner Coverage

|

Type of Dependent |

Unmarried Partner |

Same-Sex Partner |

|

Covered |

27% |

32% |

|

Not Covered |

60% |

48% |

|

Not Sure |

9% |

15% |

|

Other |

4% |

5% |

Cost Sharing

For survey participants who had increased health insurance costs in 2013, 58% passed some of the increase along to employees, 6% passed along most of the increase, and another 6% passed on all of the increased cost to employees. A generous 22% absorbed all of the increased cost.

|

Percent of premium paid by employer |

Employee coverage |

Family coverage |

|

100% of employee health insurance premiums |

22% |

5% |

|

Cover 75% to 99% of the premium for employee coverage |

46% |

27% |

|

Cover 50% to 74% of the premium |

22% |

31% |

|

Cover 1% to 49% |

3% |

9% |

|

No coverage |

1% |

18% |

|

Not sure/Other |

8% |

11% |

Cost containment

Steps employers took to reduce their organizations’ 2013 health insurance costs included:

- Raising the employee portion of the premium (20%)

- Implementing wellness programs (16%)

- Raising employee deductibles (14%)

Some employers offered HSA/HRA high deductible plans (9%) and/or raised employee copayments (7%). “Other” responses (26% of respondents) included renegotiating with provider, shopping for new provider, and converting to a self-insured program.

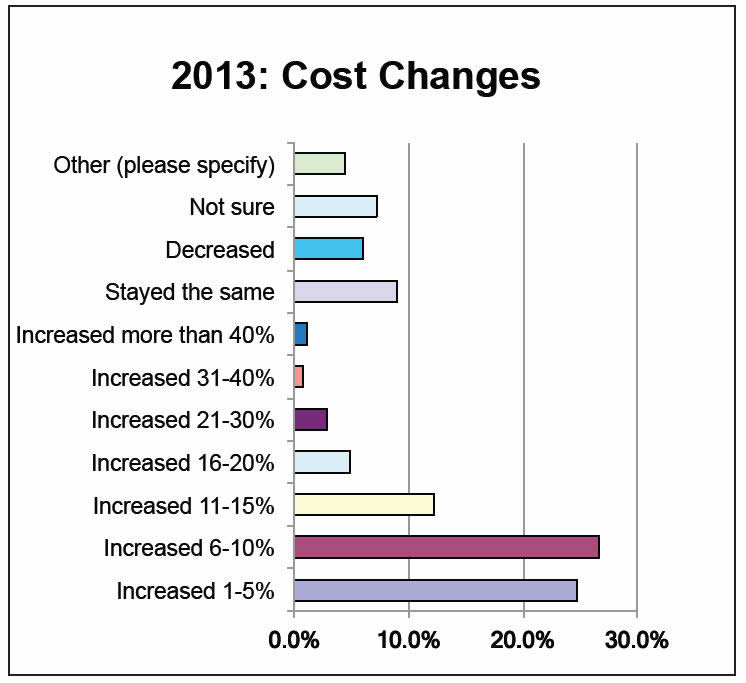

Change for 2013

Respondents indicated the following changes in healthcare costs for 2013:

Change for 2014

When asked how they think their organization’s healthcare costs will change in 2014, 38% indicated their costs will increase significantly, 37% believe their costs will increase but not significantly, 15% expect their cost to stay the same with a small inflationary increase, and 1% think their costs will go down.

To help reduce their organizations’ 2014 health insurance costs:

- 23% plan to increase employee premiums

- 19% plan to implement wellness programs

- 12% plan to raise employee deductibles or copayments

- 7% plan to offer HSA/HRA high deductible plans

- 2% plan to conduct dependent audits

Healthcare Reform

The Patient Protection and Affordable Care Act (PPACA) caused 2013 insurance costs to increase for 29% of our survey participants. It has not caused significant increases in cost, though, for 38% and 28% “don’t know yet.”

Some employers (25%) have considered dropping their healthcare benefits due to PPACA and 1% plan to do so. The majority (70%), however, plan to continue providing health insurance to their employees. The remaining 4% are not sure or are taking a “wait and see” position.

The availability of healthcare exchanges in 2014 may compel 7% of the employers responding to our survey to eliminate their group healthcare plans. The exchanges will not, however, prompt 44% to discontinue providing health insurance to their employees. Almost as many (47%), though, aren’t sure.

While 34% of our survey participants are doing their best to make sure they don’t lose their grandfathered status, 32% have already lost it and 4% expect to lose theirs this year. Eleven percent expect to lose grandfathered status in 2014, and 10% expect to lose it at some point after that, leaving 8% having not had such status or unsure when or if they will lose it.

Priorities

For healthcare benefits in 2013, the main priorities are:

|

Cost containment. |

35% |

|

Complying with healthcare reform |

30% |

|

Rethinking their long-term benefits strategy |

29% |

Offering healthcare benefits is very important to recruiting and retention efforts for 77%, and neutral or not important for 19%.

Info on Survey Participants

Organizations with up to 250 employees account for 68% of our survey participants and 21% have 251 to 1,000 employees. Another 11% employ 1,001 to 10,000 individuals and 2% of survey respondents work in organizations with more than 10,000 employees.

The participants responding to our survey are employers with 60% nonexempt employees and 91% are nonunion.

|

Privately held organizations |

61% |

|

Nonprofits |

21% |

|

Public corporations |

8% |

|

Governments |

6% |

Industries include manufacturing (18%); health care and social assistance (15%); finance and insurance (9%); and professional, technical, and scientific services (8%).

Positions held by the 2,055 participants in our survey:

|

HR Coordinator |

6% |

|

HR Generalist |

7% |

|

HR Specialist |

4% |

|

HR Manager |

7% |

|

HR Director |

23% |

|

HR VP or above |

12% |

|

Other area with HR responsibilities |

21% |

Over three-fourths (83%) of survey participants

hold exempt positions.

Thanks to all who participated in the survey!

Upcoming survey topics include:

- Retirement Benefits

- Perks

- Training and Development

I wish more employers would see the benefit in wellness programs. How do we get them to look beyond short-term costs to long-term savings?

A person in essence lend a hand in making drastically content I would state. This can be a very first time that I personally used your website site and therefore far? I personally stunned while using the study you’ve made to make this particular organize amazing. Good task!