Survey results are in for the 2014 Retirement Benefits Survey. Highlights:

- 86.6% of the employers responding to our 2014 survey offer either a 401(k) or 403(b) retirement savings plan to employees.

- 60.3% of the employers responding to our survey that offer a 401(k) or 403(b) plan to their employees also provide a matching contribution.

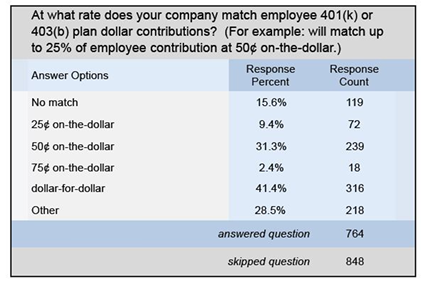

- 41.4% of employers match employee contributions dollar-for-dollar. 31.3% go 50¢ on the dollar.

- Other retirement benefits offered by our survey participants include: defined benefit plans (23.7%), Roth 401(k) (33.2%), 457 plan (13%), profit sharing (22.7%), stock options (3.9%), employee stock ownership plan (7.2%), union-sponsored pension plan (2.6%), and/or SIMPLE or SEP (4.3%)

|

401(k) or 403(b)

Offering either a 401(k) or 403(b) retirement savings plan to employees is a best practice for many U.S. employers. In fact, 86.6% of the employers responding to our 2014 survey offer one of these plans. Only 39.9% (compared to 33% in 2013) of those who answered the question, however, automatically enroll employees, though 2.3% (compared to 2.5% in 2013) plan to implement auto-enrollment in the future.

Employee Contributions

When the employee enrollment in defined contribution plans is automatic, the percent of employee earnings initially contributed is less than 3% for 23.3% (compared to 27% in 2013) of the employers who responded to this question in our survey. It is 3% for 42.7% and 4% of employee earnings for 9.7%. The employee contribution is 5% of earnings for 8.3% and 6% of earnings for 9.7%. More than 6% of employee earnings are contributed for 6.2% of survey participants.

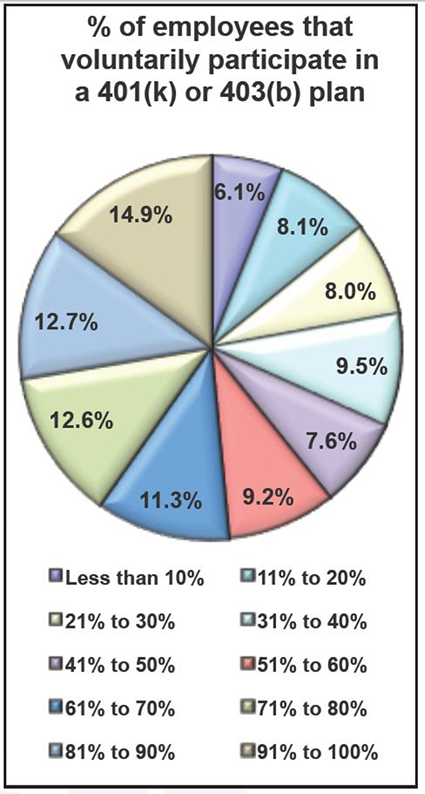

For 22.2% of survey participants, the level of voluntary participation in their 401(k) or 403(b) plans is less than 30% of employees. For 37.6%, voluntary participation is 31% to 70% of employees, and for 40.2%, voluntary participation is above 70% of employees.

ACA still slowing you down? Move into high gear on April 9 2014 with an free interactive webcast, The Affordable Care Act: Compliance is Just the Beginning. Learn More

The percentage of their earnings that employees begin with when contributing to voluntary 401(k) or 403(b) plans is less than 3% of base salary for 23.3% of our survey participants. It’s 3% of earnings for 29.3% and 4% of salary for 14.5%. Responses to our survey show that employees begin their contributions at a rate of 5% of their base salary for 15.9% of employers, at 6% of salary for 12.2%, and over 6% of earnings for 4.8% of employers.

The practice of employees adding the “cash-out” for their unused vacation or sick time to their 401(k) or 403(b) plans is permitted by 6.3% of employers and 4.1% are considering whether to allow it.

The maximum amount an employee may contribute annually to his or her 401(k) or 403(b) plan for 95.3% of employers is the highest amount allowed by the IRS, which is $17,500 for 2014.

Employer Matching

Though 18.7% have never provided an employer match, the majority (60.3%) of the employers responding to our survey that offer a 401(k) or 403(b) plan to their employees also provide a matching contribution. Though 4.4% temporarily stopped their employer match in recent years, 13.1% maintained their matching contributions throughout the recent recession.

The level of employers’ matching contributions is as high as 6% of employee earnings for 23.9% of employers, up to 5% for 14.7%, and up to 3% for 14.9% of employers. Up to 10% is the level for 3% of employers and 3.4% of survey participants match more than 10% of employee earnings.

Matching employee contributions dollar-for-dollar is the practice for 41.4% of employers. A match rate of 75¢ to the dollar is the norm for 2.4%, 50¢ on the dollar is provided by 31.3%, and 25¢ per dollar of employee contribution is standard for 9.4% of employers.

Plan Features

More than 15 investment options are offered by 50.7% of employers and 11-15 options are offered by 27.7%. Another 13.4% offer 6 to 10 investment options and 8.2% of employers in our survey offer 1 to 5 options.

Target Date/Life Cycle funds are available for 67.7% of survey participants. The in-plan Roth conversion, a feature made available by the Small Business Jobs Act of 2010, is available for 28.2%, and 3.4% are planning to add the feature.

Plan Features

More than 15 investment options are offered by 50.7% of employers and 11-15 options are offered by 27.7%. Another 13.4% offer 6 to 10 investment options and 8.2% of employers in our survey offer 1 to 5 options.

Target Date/Life Cycle funds are available for 67.7% of survey participants. The in-plan Roth conversion, a feature made available by the Small Business Jobs Act of 2010, is available for 28.2%, and 3.4% are planning to add the feature.

Other Retirement Benefits

Other retirement benefits offered by our survey participants include defined benefit plans (23.7%), Roth 401(k) (33.2%), 457 plan (13%), profit sharing (22.7%), stock options (3.9%), employee stock ownership plan (7.2%), union-sponsored pension plan (2.6%), and/or SIMPLE or SEP (4.3%).

ACA compliance? Good news! Join us April 9 for a free interactive webcast: The Affordable Care Act: Compliance is Just the Beginning. Earn 1 hour in HRCI Recertification Credit. Register Now

Benefits Planning and Administration

Retirement benefits in 2014 are about the same as 2013 for 86.7% of survey participants and more generous for 7%. It’s been 4 years or more since 26.9% of our survey participants conducted a comprehensive review of their retirement benefits package. A thorough review was conducted in 2013, however, by 43.6% and in 2012 by 15.5%.

When it comes to determining which retirement benefits to offer, 39.9% work with a consultant to create their plans, and 35.2% evaluate the benefits offered by other companies and their competitors. An employee survey to find out what employees have an interest in is conducted by 9.7%, and 41.9% are guided by the cost to the company.

Retirement benefits are managed in-house by 12.9% of those who responded to this question in our survey. Some of the administration of benefits is outsourced by 45.5%, and all administration is outsourced by 41.6%.

In tomorrow’s Advisor, more survey results, plus good news—we’re offering a free webinar that will get your Affordable Care Act compliance strategy lined up for 2014 and beyond.