In yesterday’s Advisor, we initiated our coverage of the Incentive Pay Survey; today, we feature more survey results, including how respondents fund incentives, how they communicate their plans, how they evaluate them, and how they would improve them.

|

Funding of Incentives

Our survey looked at four types of funding for variable pay plans, including discretionary funding, a percent of payroll, reduced costs, and/or increased revenue. Performance bonuses (24.3%), referral bonuses (22.7%), and 401(k) match (14.6%) are the top three plan types supported by discretionary funds. The top three funded by a percent of payroll are 401(k) match (33.4%), performance bonus (22.8%), and sales commission (9.6%).

Understandably, a cost reduction bonus at 5.7% leads the list of variable pay plans funded by reduced costs, followed by a performance bonus at 4.7%. Referral bonus and productivity bonus tie for third place at 3.5%. Sales commission (34.2%) tops the list of plans funded by increased revenue. Performance bonus (20.1%) comes in second with productivity bonus third in that list at 13.4%.

Updating

Updating their variable pay plans is as recent as within the last year for 42.9% of survey participants and within the last 2 years for 23.7%. Their plans were updated within the last 5 years for 16.7% and 11% are working with plans that have never been updated.

Responsibility

The HR/Compensation department has primary responsibility for designing and implementing plans for 39.6% of survey participants. Senior management, however, carries that responsibility for 51.3%.

Improvements Suggested

Ensuring that all employees have a clear “line of sight” regarding effort/performance to payout/reward is one way that 59.6% of survey participants believe their variable pay plan can be improved and 54.5% think that ensuring that performance goals align with corporate and department objectives will improve the program. Improving communication and increasing understanding of the plan and its objectives are tactics 51.6% could use to improve their plan. Other improvement methods include:

- Clarifying more precisely what specific performance will earn the incentive, 46.1%

- Ensuring performance goals are more attainable, 31.5%

- Eliminating performance goals that conflict with one another, 18.5%

- Streamlining implementation and administration of program(s), 26%

- Increasing the number or frequency of opportunities for employees to receive payout, 26.3%

- Increasing the number of employees eligible to receive payout, 20.6%

- Other, 4.2%

Need pay grade help? Start on November 6, 2014 with a new interactive webinar, Assembling a Pay Grade System: A Step-by-Step Guide to Getting It. Learn More.

More than one method of communication is used by survey participants to explain variable pay plans to employees, including:

- Bulletin boards or intranet, 19.8%

- Employee meetings, 39.8%

- Written materials, 49.8%

- One-on-one meetings with supervisors, 46.7%

- Other, 7%

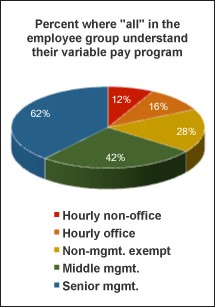

Communicating variable pay plans can be a challenge. Many are often complicated plans with intricacies that may be difficult to explain to even the most business savvy of employees. For example, only 62.4% of survey participants believe that all of their senior management team understand their variable pay program. All of middle management team members understand their programs for 42.3% and all of non-management exempt employees understand it for 27.9%.

Evaluating Effectiveness

As a general rule, measuring the effectiveness of any program is important and variable pay plans are no exception. Profit/loss metrics are used by 33.2% of survey participants to ensure their plan achieves its goals and 30.1% use organizational operating metrics. Other measurements include:

- Employee productivity, 28%

- Informal employee opinion, 24.4%

- Formal employee satisfaction survey, 22.5%

- Employee turnover, 21.4%

- Other, 4.3%

Surprisingly, 29.9% do not measure the effectiveness of their variable pay plans.

Participants

A total of 1,452 organizations participated in this survey, which was conducted in July 2014, though not all participants answered all questions. Of those who identified themselves, 64.2% are private, for-profit organizations, 18.2% are private, not-for-profit, and 17.6% are public sector.

Less than 25% of the respondents have a workforce of more than 50% exempt employees. Less than 28% of the employers surveyed have a 50–100% unionized, nonexempt workforce. Also, 47.4% have a nonexempt workforce that is less than 25% union members.

Almost two-thirds (63.3%) of the participants are in service industries; 24.4% are in agriculture, forestry, construction, manufacturing, or mining; 9.3% are in wholesale, retail, transportation, or warehousing; and 3.1% are in real estate, utilities, or “other.”

Staff level employees account for 13.7% of the survey participants who self-identified, supervisors or managers make up 40.6%, director level account for 25.6%, and 20.1% are VP level or above.

Once again, thanks to all who participated in the survey. Upcoming surveys:

- Employee leave

- Holidays

As you budget for 2015, you may be considering changes to your pay structure, to get maximum value from your employee compensation budget. Whether your goal is to reward performance, time, knowledge or a combination of all three, establishing and solidifying your pay grades is the first step in building an equitable, competitive compensation structure.

How to get there? Fortunately there’s timely help in the form of BLR’s new webinar—Assembling a Pay Grade System: A Step-by-Step Guide to Getting It Right. In just 90 minutes, you’ll learn how to properly compensate your workforce—and remedy any discrepancies you uncover.

Register today for this interactive webinar.

Pay grades for 2015? Join us November 6 for a new interactive webinar, Assembling a Pay Grade System: A Step-by-step Guide to Getting It Right. Earn 1.5 hours in HRCI Recertification Credit. Register Now.

By participating in this interactive webinar, you’ll learn:

- Laws you must consider when putting a compensation policy in place

- What pay grades are, and the correct way to determine them

- How a salary structure is built

- When to pay above market–and the times it actually makes sense to pay below market

- How pay grades interact with variable pay, and why this connection matters

- When you should consider conducting an internal equity review, and how to go about it

- Strategies for addressing pay discrepancies and inequities without opening yourself up to legal liability

- Which employers are required to comply with Executive Order 11246–and how to handle increased EEOC anti-pay-bias enforcement

- And much more!

Register now for this event risk-free.

Assembling a Pay Grade System: A Step-by-Step Guide to Getting It Right

Live webinar coming Thursday, November 6, 2014

1:30 p.m. to 3:00 p.m. (Eastern)

12:30 p.m. to 2:00 p.m. (Central)

11:30 a.m. to 1:00 p.m. (Mountain)

10:30 a.m. to 12:00 p.m. (Pacific)

Approved for Recertification Credit

This program has been approved for 1.5 credit hours toward recertification through the Human Resource Certification Institute (HRCI).

Join us on November 6—you’ll get the in-depth Assembling a Pay Grade System: A Step-by-Step Guide to Getting It Right webinar AND you’ll get all of your particular questions answered by our experts.

Train Your Entire Staff

As with all BLR/HRhero webinars:

- Train all the staff you can fit around a conference phone.

- Get your (and their) specific phoned-in or emailed questions answered in Q&A sessions that follow the presentation.

I’m impressed by the updating figures. That’s good for both employers and employees.