Changes Contemplated

Our survey shows that 9.8% of employers plan to add or make changes to their 2015 retirement benefits package, 64.9% of employers have no additions or changes planned, and 25.3% are not certain at this point in time.

For those that are planning to add or make changes to their retirement benefits, 27.4% are planning to add a defined contribution plan such as a 401(k), 403(b), or Roth 401(k), and 20.8% are planning to increase their employer match to their existing defined contribution plan, while 6.6% are planning to reduce the level of their employer match.

An increase in the length of service required for vesting of employer contributions is planned for 5.7% and 8.5% plan to reduce their length of service requirement.

Cleaning up the language in their plan documents is a priority for 25.5% and a change in how documents are distributed is planned for 12.3%. Current defined contribution plans will be eliminated for 8.5% (up from 3% last year) of participants who answered this question in our survey.

The addition of a defined benefit plan is planned for 7.5% (5% in 2013), and 14.2% (9% in 2013) expect to increase the employer contribution to their existing plan. For 11.3% (10% in 2013), however, a reduction in their employer contribution is planned.

It’s almost an even split when it comes to whether employers offer financial planning assistance to their employees, with 47.4% offering such assistance and 48.9% not providing this service to employees. The remaining 3.8% aren’t sure whether this benefit is offered.

Compensation.BLR.com, now thoroughly revved with easier navigation and more complete compensation information, will tell you what’s being paid right in your state—or even metropolitan area—for hundreds of jobs. Try it at no cost and get a complimentary special report. Read More.

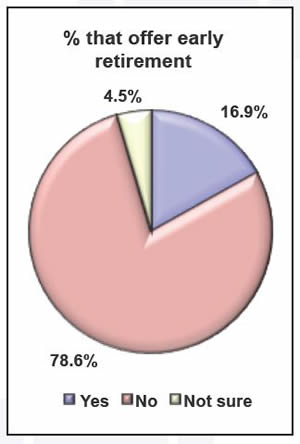

Early Retirement

Early retirement is an option for the employees of 16.9% of our survey participants. It is not offered by 78.6%, though, and 4.5% aren’t sure. Of the employers that do offer early retirement, 18.3% ask the retiring employees to sign a waiver/release of claims against the company. Surprisingly, 63.4% (55% in 2013) do not make signing a waiver/release a requirement and 18.3% are not sure if it’s a requirement.

Who Participated in the Survey?

A total of 1,612 individuals participated in this survey, which was conducted in February 2014. Of those who identified themselves, 54% represent privately owned companies, 12% are with public entities, 8% work for the government, and nonprofit organizations account for 22%.

HR/benefit managers and directors account for 55% of the survey participants who self-identified, other HR/benefit professionals make up 15%, 10% are VP level or higher, and 20% are in other areas with HR responsibilities.

The majority (58%) of our survey respondents provide HR services to a workforce of 1 to 250 employees. Another 13% provide guidance to 251 to 500 employees at their organizations, and 10% have a workforce of 501 to 1,000 employees. Companies with more than 1,000 employees account for 18% of survey participants.

Over half (53%) of the participants are in service industries; 23% are in agriculture, forestry, construction, manufacturing, or mining; 7% are in wholesale, retail, transportation, or warehousing; and 4% are in real estate or utilities. The remaining 14% selected “Other.”

A 50% to 100% unionized workforce applies to 7% of the employers surveyed. Also, 81% have a workforce with no union-represented employees. Exempt employees account for more than 50% of their workforce for 26% of survey participants.

Note: Not all participants answered all questions in the survey. Numbers have been rounded to the nearest percent.

From 401(k) matches to early retirement, the compensation and benefits field is full of challenges. “Maintain internal equity and external competitiveness and control turnover, but still meet management’s demands for lowered costs.” Heard that one before?

Many of the professionals we serve find helpful answers to all their compensation questions at Compensation.BLR.com®, BLR’s comprehensive compensation website.

And there’s great news! The site has just been revamped in two important ways. First, compliance focus information has been updated to include the latest on COBRA, Lilly Ledbetter, and the FMLA. Second, user features are enhanced to make the site even quicker to respond to your particular needs, such as:

- Topics Navigator—Lets you drill down by topical areas to get to the right data fast.

- Customizable Home Page—Can be configured to display whatever content you want to see most often.

- Menu Navigation—Displays all the main content areas and tools that you need in a simple, easy format.

- Quick Links—Enables you to quickly navigate to all the new and updated content areas.

The services provided by this unique tool include:

- Localized Salary Finder. Based on reliable research among thousands of employers, here are pay scales (including 25th, 50th, 75th, and 90th percentiles) for hundreds of commonly held jobs, from line worker to president of the company. The data are customized for your state and metro area, your industry, and your company size, so you can base your salaries on what’s offered in your specific market, not nationally.

Try BLR’s all-in-one compensation website, Compensation.BLR.com®, and get a complimentary special report, Top 100 FLSA Overtime Q&As, no matter what you decide. Find out more.

- State and Federal Wage-Hour and Other Legal Advice. Plain-English explanations of wage-hour and other compensation- and benefits-related laws at both federal and state levels. “State” means the laws of your state, because the site is customized to your use. (Other states can be added at a modest extra charge.)

- Job Descriptions. The website provides them by the hundreds, already written, legally reviewed, and compliant with the Americans with Disabilities Act (ADA) mandate that essential job functions be separated from those less critical. All descriptions carry employment grade levels to current norms—another huge time-saver.

- Merit Increase, Salary, and Benefits Surveys. The service includes the results of three surveys a year. Results for exempt and nonexempt employees are reported separately.

- Daily Updates. Comp and benefits news updated daily (as is the whole site).

- “Ask the Experts” Service. E-mail a question to our editors and get a personalized response within 3 business days.

If we sound as if we’re excited about the program, it’s because we are. For about $3 a working day, the help it offers to those with compensation responsibilities is enormous.

This one’s definitely worth a look, which you can get by clicking the link below.

Click here to get more information or start a no-cost trial and get a complimentary special report!