In yesterday’s Advisor, we began our presentation of the results of BLR’s 2014 Employee Leave Survey; today, results concerning specific types of leave. How does your organization measure up?

|

Thanks to all 3,158 individuals who participated in the survey! Here are the detailed responses. Go here for the first part of the survey analysis. Detailed results continue below.

Personal or Small Necessities Leave

Sometimes called small necessities leave, personal days are offered by 30% (same as 2013) of our survey participants, with 65.8% of them offering 1 to 3 days annually and 18.9% offering 4 to 5 days.

What Are Your Policies for Bereavement Leave?

Time off for a funeral is provided by 88.2% of survey participants, with 1 to 3 days the rule for 78.1% and 4 to 5 days for 19.6%. Bereavement for a spouse, child, or parent is available for 99% (same as 2013) of those who offer bereavement leave as a benefit. Brother and sister are included for 95.9%. Grandparents are included for 87.2% and grandchild is included for 78.7%. Stepparent and stepchild are included for 74.5% and 76.6%, respectively.

Bereavement leave for the death of an employee’s mother-in-law or father-in-law is available for 79.9% and 80%, respectively. Leave for the funeral of a brother- or sister-in-law, though, is available for 57%. Extended family members are included for 26.1% and exes (5.3%) and their family members (4.8%) are also available.

What Do You Pay for Military Leave?

Employees on military leave receive their full pay in addition to any military pay they receive for 16.1% (13.5% in 2013 and 11.5% in 2012) of the participants who responded to this question in our survey. The difference between full pay and military pay is available for 35.4% (35.5% in 2013 and 19% in 2012) and 3.9% (2.8% in 2013 and 1.5% in 2012) offer partial pay in addition to employees’ military pay. No paid military leave is available for 43.7% (40.9% in 2013 and 53% in 2012).

What Do You Pay for Jury Duty?

Of those who offer paid time off for jury duty, 47.2% (45.8% in 2013) offer full pay less any jury duty pay employees receive from the court system and 44.7% (43.6% in 2013) provide full pay in addition to pay received from the court.

Do You Give Voting Leave?

State law requires 23.8% of our survey respondents to provide paid time off for voting and another 15% provide it even though it’s not required by their state. Unpaid time off to vote is offered by 36.7% and 24.4% require employees to vote outside their business hours.

Who Gets Notified?

Employees are required to notify their supervisor when requesting sick, vacation, PTO, or personal leave for 79.1% and their manager for 38.7%, with 15.8% requiring them to notify HR.

Are class action lawyers peering at your comp practices? It’s likely, but you can keep them at bay by finding and eliminating any wage and hour violations yourself. Our editors recommend BLR’s easy-to-use FLSA Wage & Hour Self-Audit Guide. Click here for details.

Exempt Employees—PTO Loan? Partial Day Deductions?

When asked whether they allow employees to use paid time before it’s accrued, 64.5% indicate that they do not allow negative accrual balances. When asked whether they deduct from exempt employees’ accrued leave to cover partial-day absences, however, 41.4% of survey participants who answered the question indicated they do not. For 14.3%, however, the answer was yes, with the amount of time depending on the situation. Deductions in half-day increments are made for 22.2% and 9% deduct in hourly increments. Half-hour deductions are allowed for 4.9% and 8.2% deduct quarter hours.

May Leave Be Rolled Over

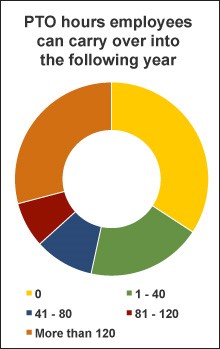

Use it or lose it is the rule of thumb for 18.7% (18.5% in 2013) and, though they can’t roll it over, 3.8% (3.3% in 2013) reimburse employees for all or part of their unused paid leave. Rollover of all or a portion of unused paid leave time from one year to the next, however, is an option for 77.5% (70.8% in 2013) of survey respondents.

For 34.9%, employees can roll over more than 120 hours of accrued vacation time and 11.1% allow 81 to 120 hours to be rolled over. The number of PTO hours that employees are allowed to rollover are similar, with 29.1% allowing more than 120 hours and 7.6% allowing rollover of 81 to 120 hours.

Use or Take the Cash?

When asked which types of leave survey respondents pay out to employees when they leave the company, 63.9% pay for vacation, 11% pay out sick time, 34.1% pay out any unused PTO, and 7.7% don’t pay cash for unused paid leave. With some limitations, 34.7% allow employees to “cash in” accrued but unused paid leave at the end of the year and 9.9% allow “cash in” with no limitation.

Can You Donate Leave?

While 33.4% (up from 29.4% in 2013 and 25% in 2012) of survey participants allow some degree of leave sharing or donating, no sharing paid leave between employees is the rule for 55.9% (54.7% in 2013 and 56% in 2012) of survey participants. This issue has never been addressed by 10.8% (13.5% in 2013 and 17% in 2012).

Who Gets Notified About FMLA?

For 84.3% of survey participants who answered the question, employees are required to notify HR when requesting FMLA leave and 87.1% also require employees to notify their supervisor or manager. When it comes to use of intermittent FMLA leave, however, 73.9% require notification to HR and 90% require employees to notify their management team. HR is responsible for tracking FMLA at 79.9% and supervisors or managers are responsible at 4%. Using accrued paid leave when on FMLA leave is required by 75.1% and 61.9% require employees to use FMLA leave concurrent with workers’ compensation when applicable.

What Are the Top Challenges with Employee Leave?

When asked to indicate their top challenges regarding employee leave, scheduling workloads around employee leave topped the list at 49.8% (47% in 2013). Recordkeeping and/or tracking leave at 37% (38.9% in 2013) and abuse of leave at 36.5% (37.7% in 2013) came in second and third, respectively. FMLA intermittent leave came in fourth at 33.5% (33.2% in 2013) and consistent application of leave policies was fifth at 33.5% (27.1% in 2013).

Participants in This Survey

A total of 3,158 individuals, with 79% at manager level or above, participated in this survey conducted in September 2014. Of those who identified themselves, 59.7% represent privately owned for-profit companies, 8.6% are with public entities, and 23.2% work for government or nonprofit organizations.

Companies with 1 to 250 employees account for 61.8% of survey participants. Companies with 251 to 500 employees make up 12.6% and organizations with 501 to 1,000 comprise 8.6%. Rounding out the group, companies with more than 1,000 employees account for 16.9% of survey participants.

Less than 8% of the employers surveyed have a 50 to 100% unionized workforce. Also, 87.2% have a workforce that is less than 25% union employees. Less than 25.2% of the respondents have a workforce of more than 50% exempt employees.

Over half (56.7%) of the participants are in service industries; 20.5% are in agriculture, forestry, construction, manufacturing, or mining; 7.3% are in wholesale, retail, transportation, or warehousing; and 4.1% are in real estate or utilities.

Again, thanks to all who participated!

From developing policies on leave to maintaining equity to paying employees correctly, comp management never sleeps. And violations, especially in wage and hour, are all too easy to incur. In fact, the numbers suggest that it’s likely that there are wage and hour violations in your workplace. Are some of your employees working off the clock or not getting the overtime to which they are entitled? There’s only one way to find out—audit before “they” do.

“They” might be the feds, your employees’ lawyers, or even bankers deciding you don’t get that loan because improperly classified workers represent a huge potential liability.

Yes, there’s only one way to find out what sort of wage and hour shenanigans are going on—regular audits.

To accomplish a successful audit, BLR’s editors recommend a unique checklist-based program called the Wage & Hour Self-Audit Guide. Why are checklists so great? It is because they’re completely impersonal, and they force you to jump through all the necessary hoops, one by one. They also ensure consistency in how operations are conducted. And that’s vital in compensation, where it’s all too easy to land in court if you discriminate in how you treat one employee over another.

Experts say that it’s always better to do your own audit and fix what needs fixing before authorities do their audit. Most employers agree, but they get bogged down in how to start, and in the end, they do nothing. There are, however, aids to making Fair Labor Standards Act (FLSA) self-auditing relatively easy.

What our editors strongly recommend is BLR’s Wage & Hour Self-Audit Guide®. It is both effective and easy to use, and it even won an award for those features. Here are some reasons our customers like it:

- Plain English. Drawing on 30 years of experience in creating plain-English compliance guides, our editors have translated FLSA’s endless legalese into understandable terms.

- Step-by-step. The book begins with a clear narrative of what the FLSA is all about. That’s followed by a series of checklists that utilize a simple question-and-answer pattern about employee duties to find the appropriate classification.

All you need to avoid exempt/nonexempt classification and overtime errors, now in BLR’s award-winning FLSA Wage & Hour Self-Audit Guide. Find out more.

- Complete. Many self-audit programs focus on determining exempt/nonexempt status. BLR’s also adds checklists on your policies and procedures and includes questioning such practices as whether your break time and travel time are properly accounted for. Nothing falls through the cracks because the cracks are covered.

- Convenient. Our personal favorite feature—a list of common job titles marked “E” or “NE” for exempt/nonexempt status. It’s a huge work saver.

- Up to date. If you are using an old self-auditing program, you could be in for trouble. Substantial revisions in the FLSA went into effect in 2004. Anything written before that date is hopelessly—and expensively—obsolete. BLR’s Wage & Hour Self-Audit Guide includes all the changes.

Learn More about BLR’s Wage & Hour Self-Audit Guide.