Creelman, CEO of Creelman Research, offered his tips at a recent BLR® webinar sponsored by Halogen Software. He was joined by Halogen’s Director of Marketing Communications Connie Costigan.

|

The Best Way to Start

For those new to human capital reporting, Creelman recommends the following:

- Do something internal now, so you are ready to do something external when asked.

- Do something relevant, concise, and easy for stakeholders to understand.

- Pick three strategic business initiatives, and then, tell the story of how human capital investments support those initiatives.

- Make sure you have some metrics to support your story.

- Frame the “so what?” in terms of risk management.

- Later on, add in any other metrics stakeholders expect.

For example:

- Issue: Rapid growth in China; can’t recruit fast enough.

- Human capital investment: New software to speed recruitment.

- Story: Explain what the issue is and why it is a risk.

- Metrics: Provide metrics, e.g., Number of hires, Time to fill (in China), Quality of hire (in China).

- Risk: Describe the risk: Insufficient recruitment would put revenue targets at risk.

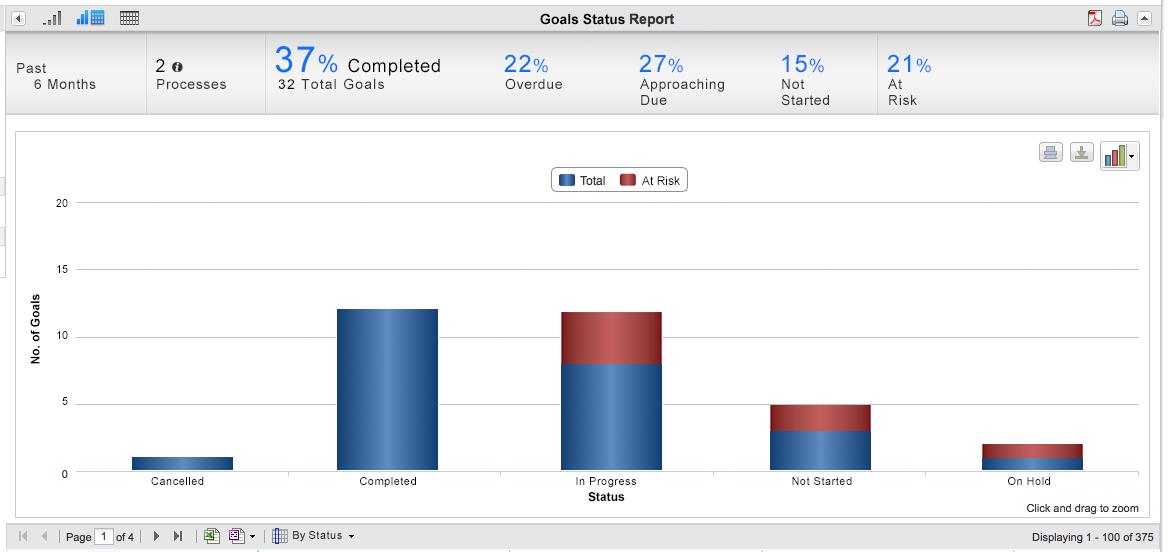

Costigan offered the following as examples of the kind of metrics and reports that HR software systems can provide (click any image to enlarge it):

Are class action lawyers peering at your comp practices? It’s likely, but you can keep them at bay by finding and eliminating any wage and hour violations yourself. Our editors recommend BLR’s easy-to-use FLSA Wage & Hour Self-Audit Guide. Click here for details.

Recommendations

Creelman offers the following basic recommendations:

- Learn the basics of your business and industry, and talk to leadership about “human capital reporting” in whatever context it will capture their interest.

- Pilot an HR report to work through the process.

- Create a road map to build needed systems and processes.

- Ask to be involved.

One of the risks that most employers face is the huge potential liability that wage and hour problems (like improperly classified workers or unpaid overtime) represent. The liability isn’t just from the feds or your employees’ lawyers; it could for example, be bankers deciding you don’t get that loan because of concerns around the liability.

And there’s only one way to find out what sort of wage and hour shenanigans are going on—regular audits.

To accomplish a successful audit, BLR’s editors recommend a unique checklist-based program called the Wage & Hour Self-Audit Guide®. Why are checklists so great? It is because they’re completely impersonal, and they force you to jump through all the necessary hoops, one by one. They also ensure consistency in how operations are conducted. And that’s vital in compensation, where it’s all too easy to land in court if you discriminate in how you treat one employee over another.

Experts say that it’s always better to do your own audit and fix what needs fixing before authorities do their audit. Most employers agree, but they get bogged down in how to start and, in the end, they do nothing. There are, however, aids to making the Fair Labor Standards Act (FLSA) self-auditing relatively easy.

What our editors strongly recommend is BLR’s Wage & Hour Self-Audit Guide®. It is both effective and easy to use, and it even won an award for those features. Here are some reasons our customers like it:

- Plain English. Drawing on 30 years of experience in creating plain-English compliance guides, our editors have translated FLSA’s endless legalese into understandable terms.

- Step-by-step. The book begins with a clear narrative of what the FLSA is all about. That’s followed by a series of checklists that utilize a simple question-and-answer pattern about employee duties to find the appropriate classification.

All you need to avoid exempt/nonexempt classification and overtime errors, now in BLR’s award-winning FLSA Wage & Hour Self-Audit Guide. Find out more.

- Complete. Many self-audit programs focus on determining exempt/nonexempt status. BLR’s also adds checklists on your policies and procedures and includes questioning such practices as whether your break time and travel time are properly accounted for. Nothing falls through the cracks because the cracks are covered.

- Convenient. Our personal favorite feature—a list of common job titles marked “E” or “NE” for exempt/nonexempt status. It’s a huge work saver.

Up to date

If you are using an old self-auditing program, you could be in for trouble. Substantial revisions in the FLSA went into effect in 2004. Anything written before that date is hopelessly—and expensively—obsolete. BLR’s Wage & Hour Self-Audit Guide includes all the changes.